10911 Technology Place, San Diego, CA 92127

858-436-7770 | www.xperagroup.com

Short-Term Rentals

In the City of San Diego:

An Economic Impact Analysis

October 2017

Prepared by

Alan Nevin, Director

Economic Research Division

Xpera Group

For

Share San Diego

HomeAway/Expedia

Austin Texas

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 2 of 36

Introduction

Xpera Group has undertaken and now completed an analysis of the short-term lodging

industry in the City of San Diego. An earlier study on the same topic was completed by

the National University System Institute of Policy Research in October 2015.

This study has five elements:

• Section 1: The Economic Benefits of Short-term Lodging to the City and

County of San Diego.

• Section 2: The Short-Term Lodging Market and Its Effect on Hotel

Occupancy and Rates

• Section 3: The San Diego Traditional Housing Market

• Section 4: The Short-Term Lodging Market in the City of San Diego & Its

Effect on the Availability of Housing; and

• Section 5: Research on the California and San Diego tourism/hotel market.

Facts and data for this study were gathered from the U.S. Census Bureau, U.S.

Department of Commerce, San Diego Tourist Authority, City of San Diego’s Treasurer’s

office, San Diego Port District, San Diego County Assessor, Voice of San Diego,

HomeAway, Airdna.co, Airbnb, Expedia, STR, Dean Runyan Associates, TNS Travel

America, CBRE and from Xpera Group’s extensive database. All exhibits note the source

of the data.

We wish to acknowledge the cooperation of the National University System Institute of

Policy Research. For the most part, we followed its methodology and, when, possible,

utilized the same sources of data. We also received data directly from the short-term

lodging industry.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 3 of 36

Study Purpose and Key Findings

The purpose of this study is to assess the economic and fiscal impacts of the short-term

lodging market on the City of San Diego and to assess the relationship between short-

term lodging market and both the hotel market and the traditional long-term residential

sale and rental markets.

Short-Term Lodging and Effect on the Hotel Market

We have reviewed numerous studies on the effect of short-term lodging and the hotel

market in the United States in preparation for this study.

The San Diego County hotel market in 2016 had among the highest occupancy rates

and highest revenues per room of all the major tourism metropolitan areas in the United

States. Projections for 2017 indicate that the favorable trend will continue.

The City of San Diego hotel market shares in the County’s hotel market’s occupancy

and room rate success in recent years.

Much of the health of the hotel market relates to the general economic health of the

economy and, as important, the growth of the foreign visitor market, particularly the

Chinese visitor market.

A substantial portion of the short-term lodging market is not a candidate for traditional

hotel rooms, either because of budgetary considerations or because hotel room

configurations do not appeal to the family market or larger parties traveling together and

who want the privacy of an entire residence.

Most studies indicate that total short-term lodging nights in the U.S. are equal to

approximately 2.4% of total hotel room nights, a percentage that is anticipated to

increase over the next few years.

We have reached the conclusion that short-term lodging as a percent of total occupied

room nights is less than 3.0% and that a substantial portion of that 3.0% would not

utilize traditional hotels because of cost (particularly in high occupancy periods) and

preference to be in a private residence or share a residence.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 4 of 36

The Short-Term Lodging Market and its Effect on the Rental Housing

Market

The short-term lodging market is growing internationally and certainly within the city and

county of San Diego.

Its growth is somewhat limited by the prohibition of short-term lodging in professionally

managed apartment and condominium projects and in several better-quality master-

planned communities.

The short-term lodging market consists of three types of lodging: room-sharing, private

room in an owner or renter-occupied residential unit; and the rental of an entire

residence.

This study concentrates on the rental of an entire residence when the owner or renter is

not in residence for a substantial portion of the year and therefore the unit would not be

available to the traditional owner-occupied or rental market.

The Economic Benefits to the City and County of Short-Term Lodging

We have concluded that the direct effect of spending on short term lodging in the

City of San Diego will be almost $300 million in 2017. In addition, there is indirect

and induced spending of another $200+ million that relates to the multiplier effect

of direct dollar expenditures.

In addition, the City will have sales tax generation of almost $700,000.

In total, in 2017, we project that the short-term lodging business will produce

almost $500 million in the City of San Diego.

In addition, the short-term lodging industry will create more than 3,000 jobs in the

City in 2017.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 5 of 36

Category

Total Output

($Millions)

Employment

Direct Effect Expenditures 286,955,443$ 1,674

Lodging 193,093,700$

Non-Lodging (1) 93,861,743$

Indirect & Induced Effect

Indirect Effect 31,941,000$ 194

Induced Effect 162,240,000$ 1,240

Total Indirect & Induced Effect 194,181,000$ 1,435

Sales Tax Generation 683,189$

Total 481,819,632$ 3,109

(1) Assume 75% spent in the City of San Diego (the total amount is $125,148,991)

Source: Indirect & induced effect based on Natiional University study & IMPLAN model

Economic Impact &

Employment Generation

Short-Term Lodgers

City of San Diego

2017 (P)

Exhibit 1

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 6 of 36

Section 1: The Economic Benefits of Short-Term Lodging to the

City and County of San Diego

In this section, we determine the economic benefits of short-term lodging for the City of

San Diego. The spending falls into two categories: lodging and non-lodging:

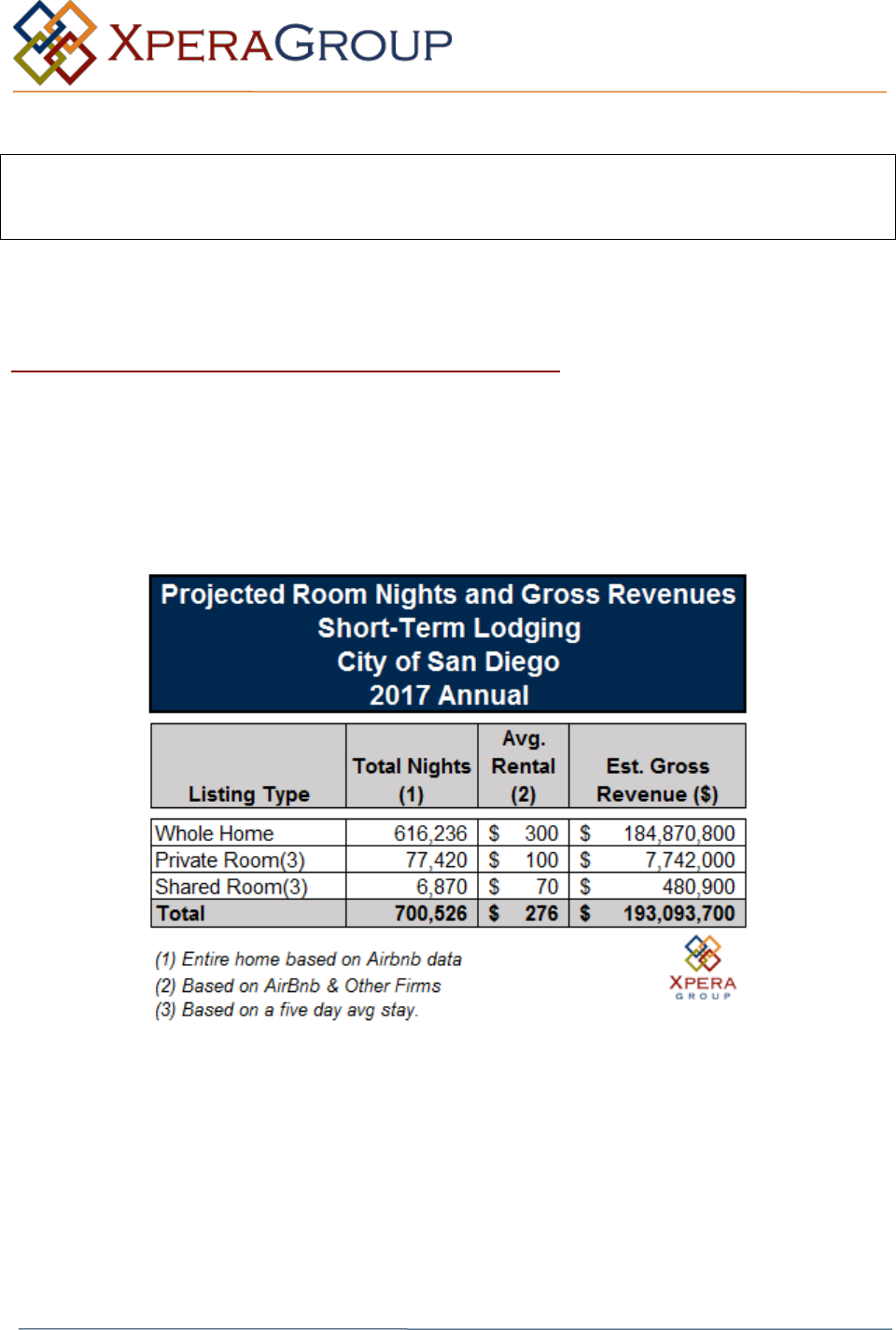

Section 1-1: TOT from Spending on Lodging

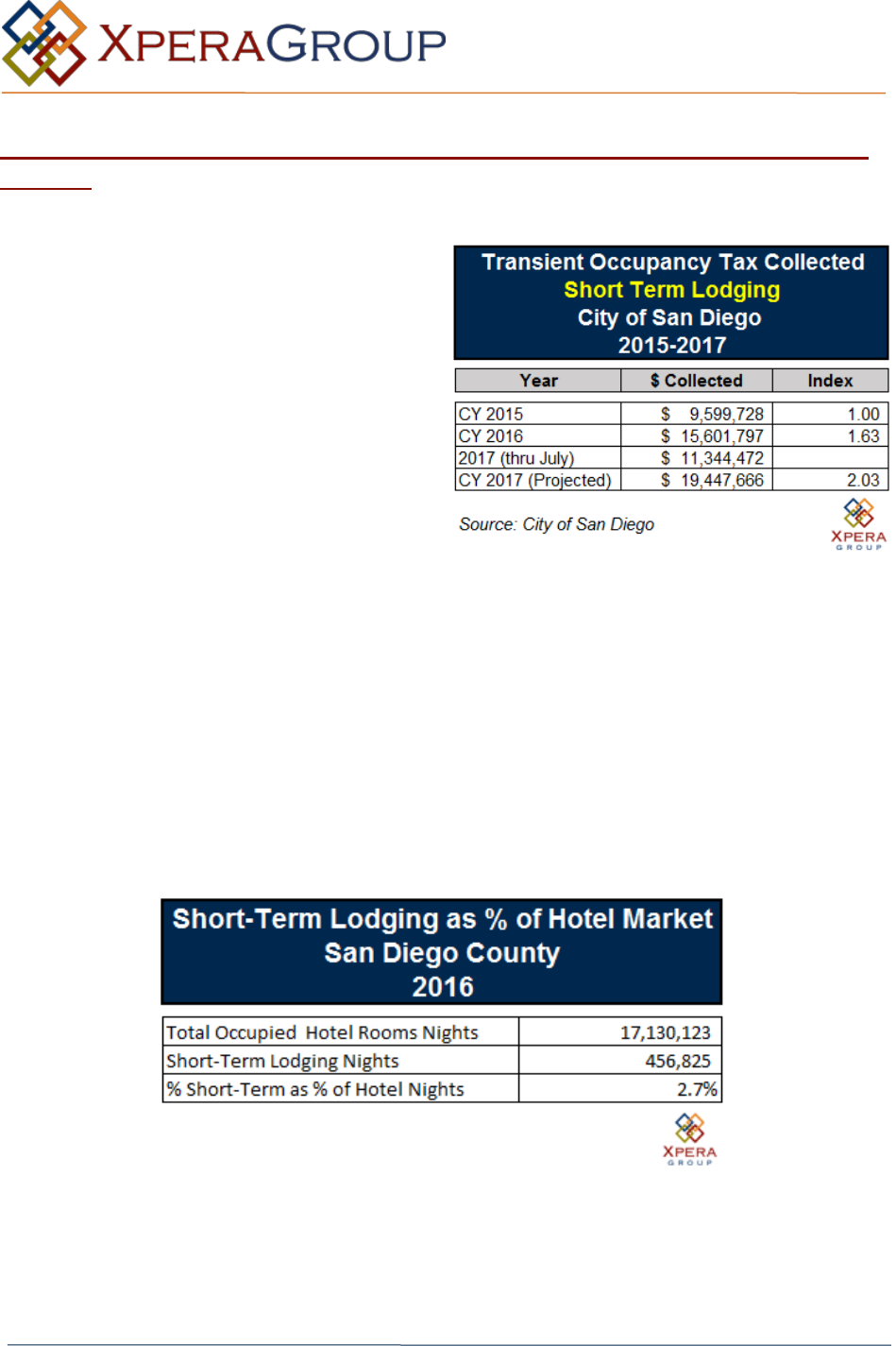

Based on TOT collected in the first six months of 2017, we project that the total to be

collected in 2017 will be more than $19 million. It is likely that as the collection

procedures get more sophisticated the City’s TOT will grow faster than the number of

nights rented.

Exhibit 2

These figures relate to the $110,000,000 total computed three ago in the National

University study, reflecting a substantial increase in bookings and rates.

In order to avoid exaggeration of revenues, we have assumed that the gross revenues

shown above represent the entire short-term lodging market in the City of San Diego.

As noted earlier, actual room night totals from multiple sources are not available, though

we know that virtually all short-term lodging units are listed on multiple sites.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 7 of 36

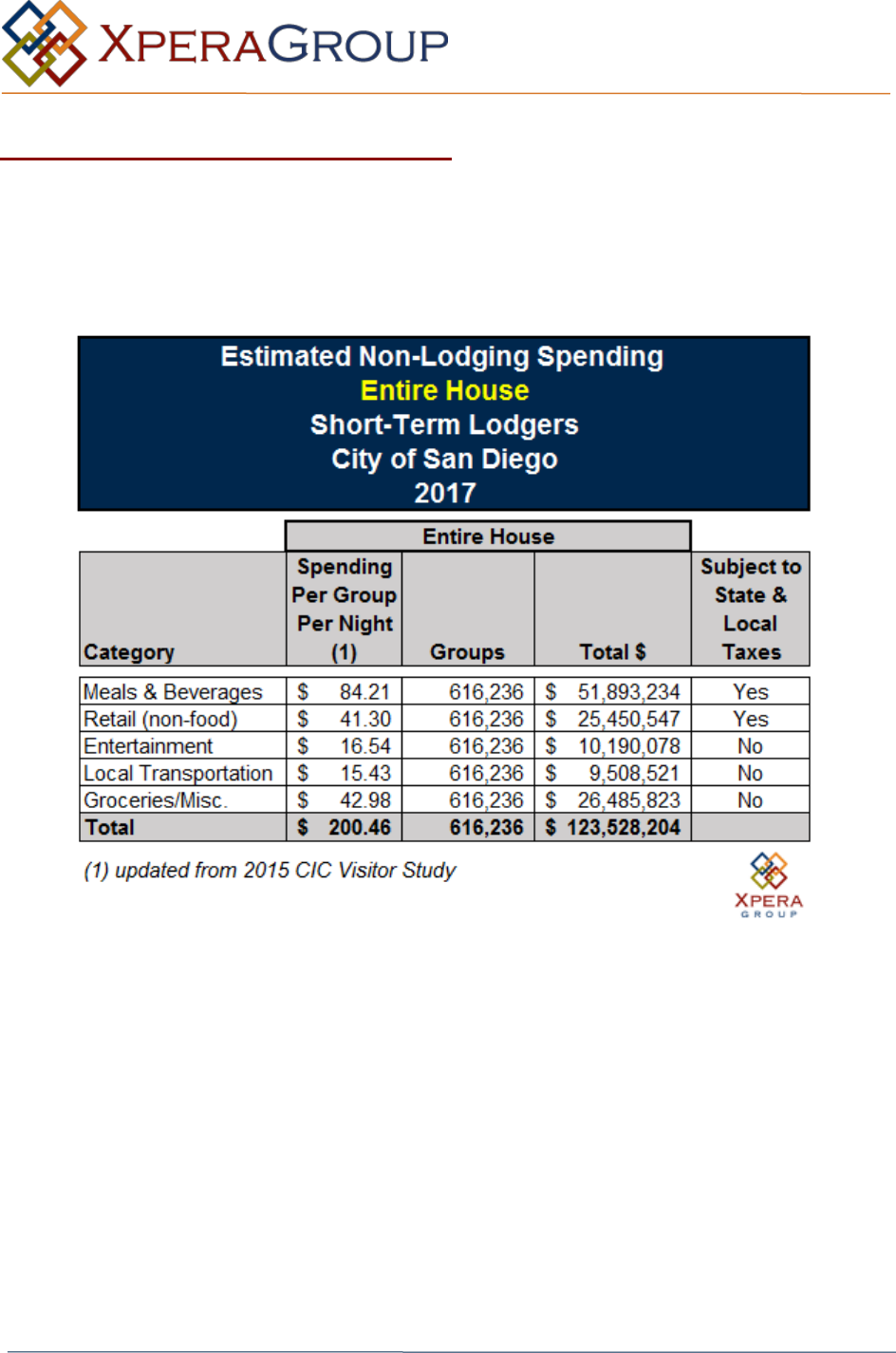

Section 1-2: Non-Lodging Spending

Non-lodging spending includes meals and beverages, entertainment, local

transportation and other items that visitor typically spend. Based on a CIC Visitor Study

the typical “visitor group” spends $200 per night in addition to lodging.

Exhibit 3

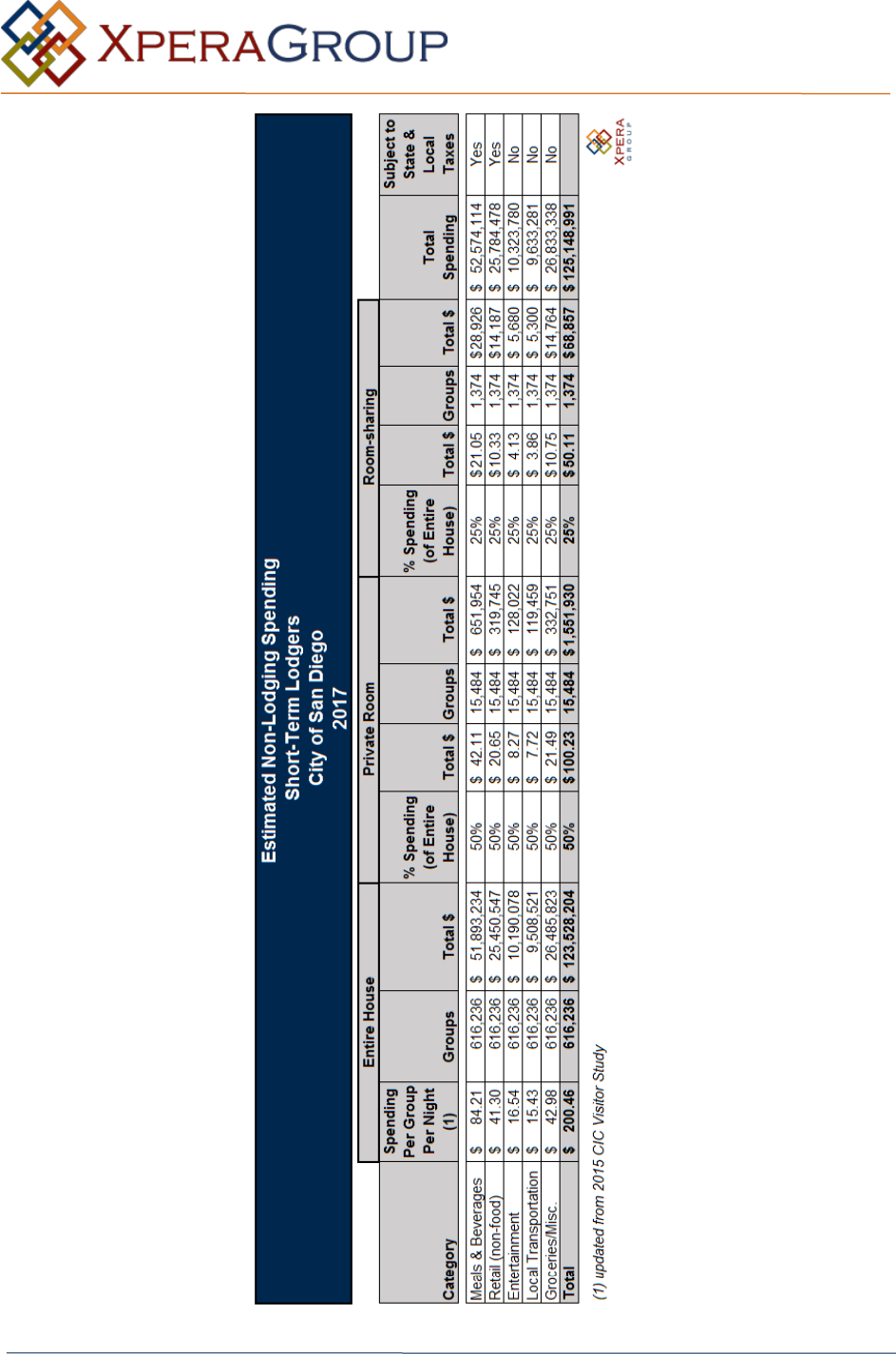

We assumed that the $200.46 would be for an entire home lodging. In addition to the

entire house short-term lodgers, we add the private room and room-sharing spending at

50% and 25% of the amount of the entire home spending.

In total, the spending on non-lodging totals $125,148,991, as shown here:

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 8 of 36

Exhibit 4

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 9 of 36

Section 1-3: Total Direct & Indirect Spending

Tourism spending falls into two basic categories; Direct and Indirect/Induced

Expenditures.

Direct expenditures are those dollars expended by short-term lodgers on their lodging

and non-hotel expenditures such as food, entertainment and rental cars.

Indirect and induced expenditures are those that are part of the multiplier effect. For

example, when the owner of a lodging facility then spends their proceeds on personal

items like food or entertainment that creates another round of consumer spending.

The exhibit below details the expenditures. The exhibit also projects the number of jobs

created by short-term lodging. For 2017 we have projected that short-term lodging will

create more than 3,000 jobs.

Exhibit 5

Category

Total Output

($Millions)

Employment

Direct Effect Expenditures 286,955,443$ 1,674

Lodging 193,093,700$

Non-Lodging (1) 93,861,743$

Indirect & Induced Effect

Indirect Effect 31,941,000$ 194

Induced Effect 162,240,000$ 1,240

Total Indirect & Induced Effect 194,181,000$ 1,435

Sales Tax Generation 683,189$

Total 481,819,632$ 3,109

(1) Assume 75% spent in the City of San Diego (the total amount is $125,148,991)

Source: Indirect & induced effect based on Natiional University study & IMPLAN model

Economic Impact &

Employment Generation

Short-Term Lodgers

City of San Diego

2017 (P)

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 10 of 36

The multiplier effect (indirect and induced) was determined through the use of an

economic model created by the U.S. Department of Commerce 30 years ago (when we

first used it in a study) and has been refined since. It is a highly sophisticated model that

explains the ripple effect of spending in the economy, by industry.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 11 of 36

Section 2: The Short-Term Lodging Market and Its Effect on

Hotel Occupancy and Rates

The short-term lodging market has been a staple of European countries for decades

and has only recently become a factor in accommodating persons touring in America.

Section 2-1: The Short-Term Lodging Market

The short-term lodging market in the U.S. has blossomed of late largely because of the

opportunities that have availed themselves on the web. Major sites such as HomeAway

and VRBO have dramatically broadened the opportunity for travel, both in the U.S. and

abroad.

It has been of particular significance for persons who cannot afford traditional hotel

accommodations, especially in the key marketplaces that attract the most tourists, like

New York, Los Angeles, Washington, D.C., Orlando and San Diego. It has been a

particular boon for the family market because of the ability to house a couple with

children in an entire home or condominium for rent.

In addition, there has been a substantial expansion of foreign visitations in the past few

years, heavily from the Far East and predominantly Chinese. This foreign visitor

expansion has been a major positive factor in hotel occupancy in the popular tourist

cities, both in the U.S. and in Europe.

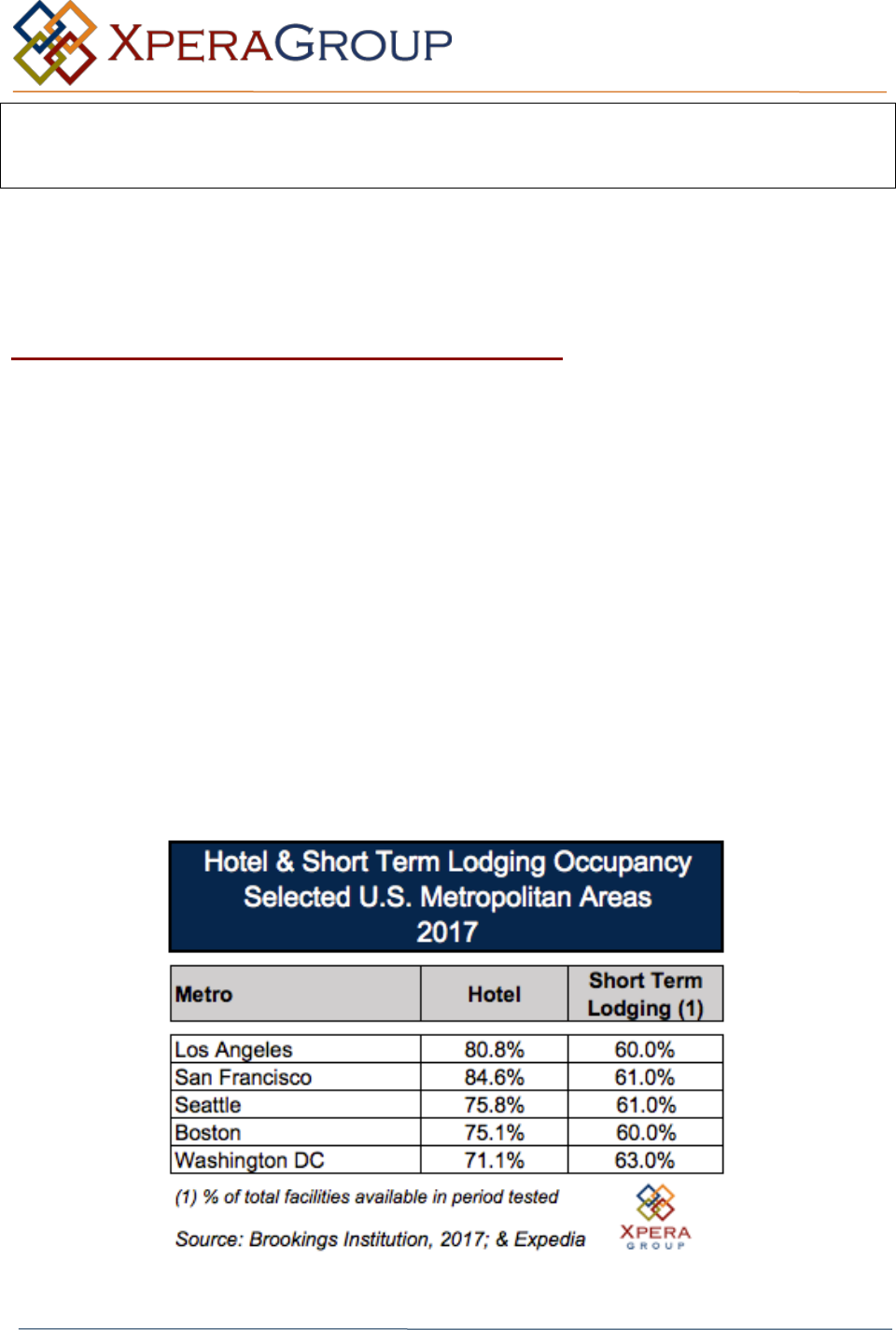

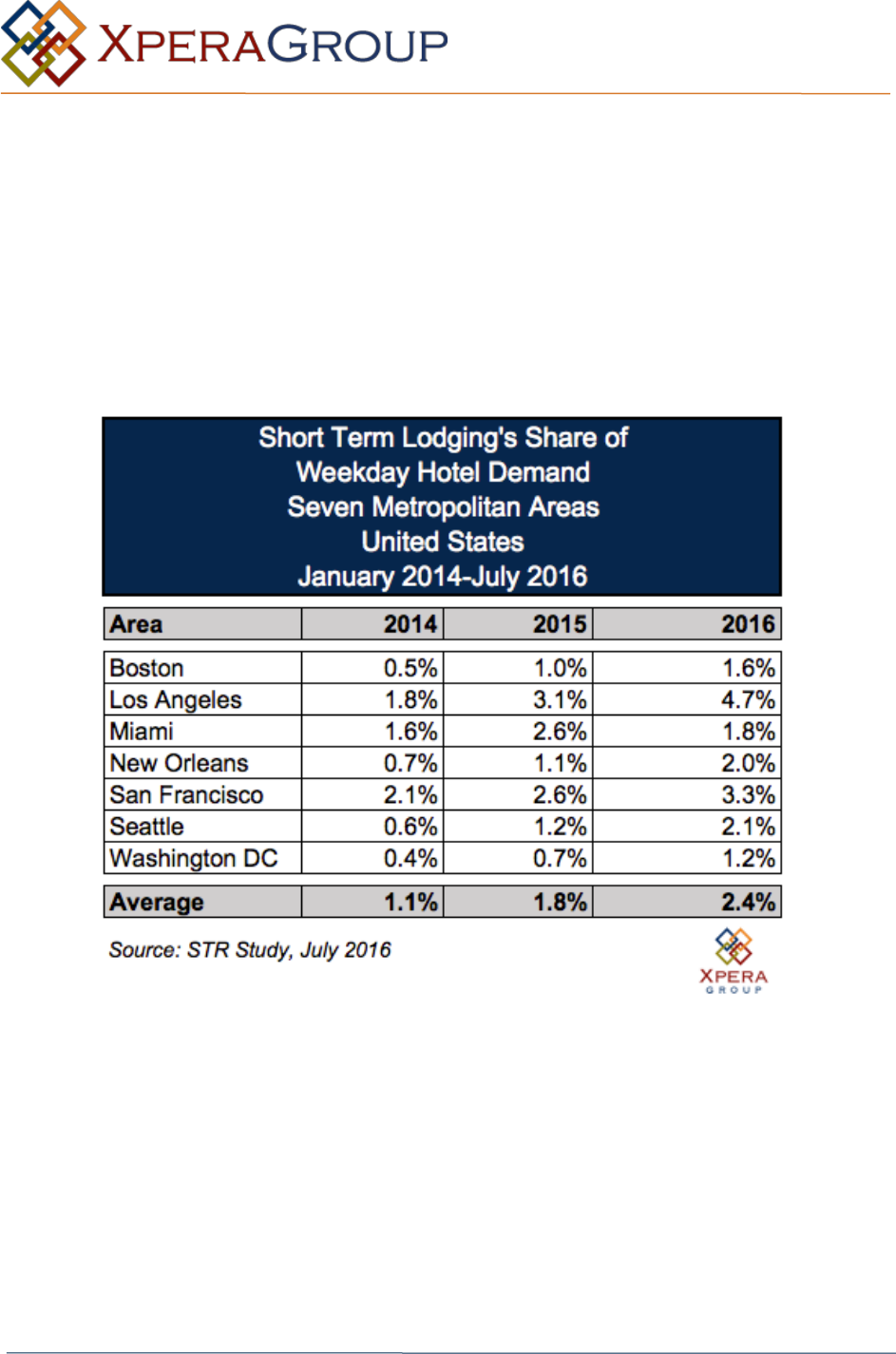

Exhibit 6

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 12 of 36

The Pew Research Center recently completed an in-depth survey of the “shared”

economy. The study reported that 11% of American adults have used online services

such as HomeAway or VRBO to obtain lodging overnight in a private residence. The

study showed that those using the shared facilities included a broad range of ages,

ethnicity, education and income.

The short-term lodging reports that its occupancy rates for available facilities is typically

half the occupancy rate of hotels in major metropolitan areas around the U.S. that have

the highest occupancy rates.

STR, a leading hotel research firm, recently completed a “Short Term Lodging and Hotel

Performance Study.” The study only focused on “entire homes an/d condominiums.” Its

findings did not include shared housing. Its findings were interesting:

➢ As of July 2017, the hotel industry has recorded its 77

th

consecutive month of

revenue-per-available-room growth.

➢ Short term lodging occupancy generally was highest in markets where hotels had

high occupancy.

Exhibit 7

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 13 of 36

➢ Hotel occupancy was significantly higher than short term lodging occupancy.

➢ While short term lodging’s share of total accommodation supply (i.e., short term

lodging and hotel rooms) was growing, its share of market demand and revenue

still was generally below 3.0%.

➢ Short term lodging guests typically lodged longer than the average hotel guest,

with roughly half of short term lodging room nights coming from trips of seven

days or longer.

➢ Short term lodging guests tend to be much younger than hotel guests and have a

higher percentage of females than hotels.

➢ The number of nights during which hotels have experienced 95% or higher

occupancy has gradually increased, rising from 15 in 2010 to 71 in 2016.

➢ In those high occupancy periods, hotels saw no degradations of their rate

premiums which were 35% higher than their regular rates.

As part of the study, which examined seven major metropolitan areas including Los

Angeles and San Francisco, short term lodging’s share of weekday demand has

increased steadily in the past three years, but in most cases, did not rise above 3.0%.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 14 of 36

Section 2-2: Short-Term Lodging as % of the Hotel Market, San Diego

County

Based on dollar figures that the City of San

Diego provided to us, the City collected

$15.6 million in short-term lodging TOT in

2016 and based on the first half of 2017

will collect more than $19.0 million in

2017. This short-term total represents a

200% increase over 2015. We attribute this

to the major short-term lodging websites

that only recently (fall 2015) began to

withhold short-term lodging TOT.

Based on research in other markets and the given strength of the local hotel market, it is

difficult to arrive at a conclusion other than that the short-term lodging market has had a

minimal and/or negligible effect on the hotel market.

We have reached the conclusions that short-term lodging as a percent of total occupied

room nights is less than 3.0% and that a substantial portion of that 3.0% would not

utilize traditional hotels because of cost (particularly in high occupancy periods) and a

preference to be in a private residence or share a residence.

Exhibit 9

Exhibit 8

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 15 of 36

Section 3: The San Diego Traditional Housing Market

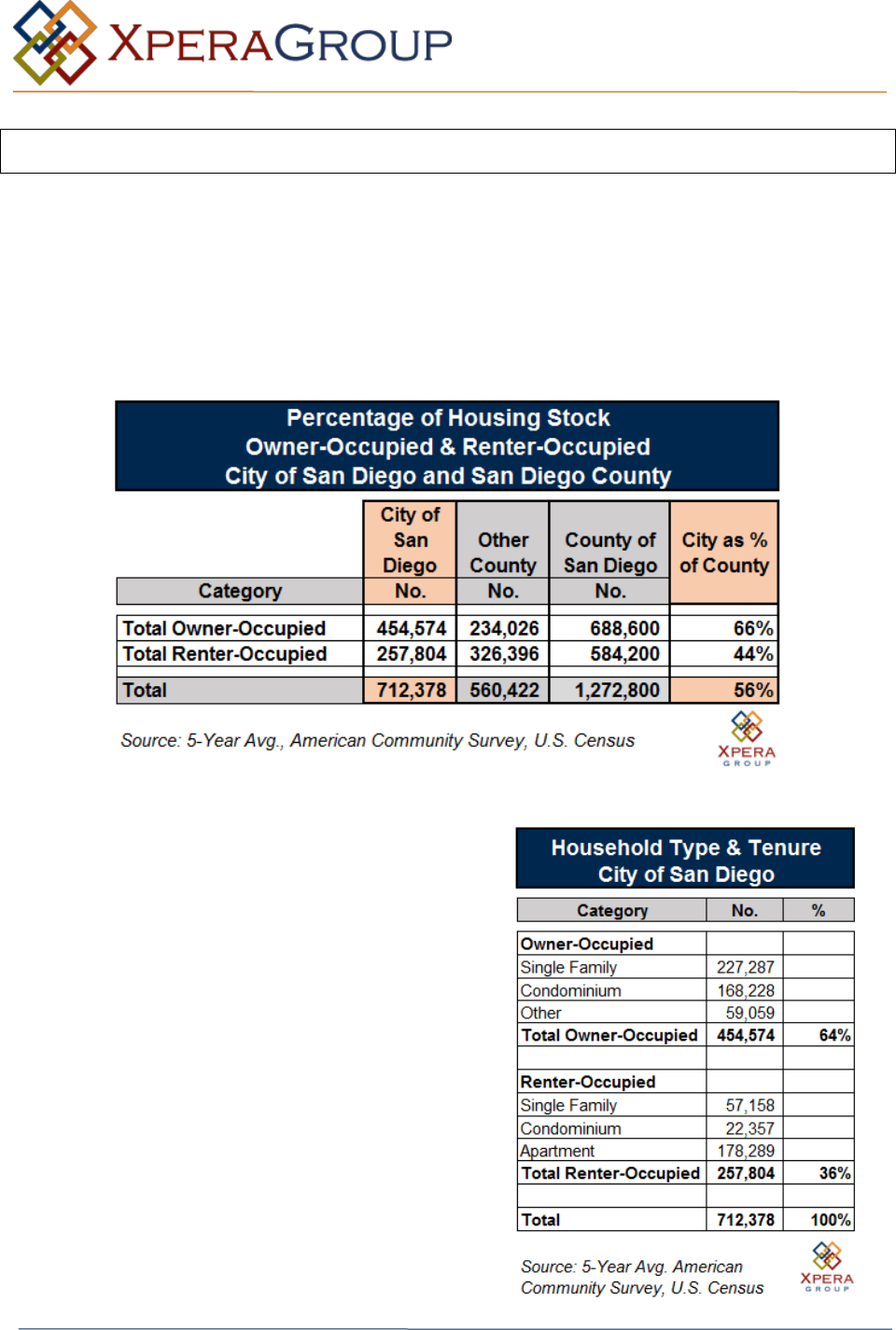

As a background for a discussion of the short-term occupancy market, we have

prepared data on the number of housing units in the County and the City of San Diego.

The City of San Diego has 66% of the County’s owner-occupied housing and 44% of its

renter-occupied housing.

Exhibit 10

Within the City of San Diego, of the total

housing inventory, 64% is owner-occupied and

36% renter-occupied.

This study will focus on owner-occupied

housing for this reason:

Renter-occupied housing is typically bound by

leases that prohibit subletting, although it is

difficult to monitor home-sharing as long as the

renter is in residence. Also, it would be difficult

to monitor a situation where tenants rent their

unit while they go on a vacation. In any event,

home-sharing would rarely have an effect on

the overall supply and demand of rental

housing.

Exhibit 11

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 16 of 36

Within the rental housing category, there are a substantial number of homes and

condominiums in the Pacific Beach area that have been rented to the vacation market

for decades and have never really been part of the local housing stock. It has proven

difficult to accurately document the total number in that category.

Thus, we will focus on the 227,287 single family homes and 168,228 condominiums in

the City. We do not envision a situation where mobile homes or other owner-occupied

forms of housing are part of the short-term lodging inventory.

Our research indicates that many, if not most, homeowner associations have taken a

strong stand against short-term vacation renters and often levy substantial fines for

violations.

Similarly, several major master-planned communities, like Del Sur, have also placed

prohibitions on short-term rentals.

We should note that the City Council and Mayor of the City of San Diego are newly

putting forth an effort to alleviate the housing shortage. This effort is focused on

producing both new sale and rental housing, particularly in transit-oriented locations.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 17 of 36

Section 4: The Short-Term Lodging Market in the

City of San Diego & Its Effect on the Availability of Housing

The short-term housing market in San Diego County has grown exponentially in the

past few years, mirroring the growth of that industry in other major metropolitan areas.

It is segmented into three categories: entire home, private room and room-sharing.

Documenting the total number of housing units involved in short-term lodging is rather

difficult for these reasons:

• Currently, virtually all of the City’s TOT revenues come from the major short-term

lodging firms like HomeAway and VRBO, but they do not represent the entirety of

the market, by far, especially for the rental of private rooms and room-sharing.

• Virtually all property owners of short-term lodging units advertise on multiple

listing sites, so adding the listings of the major firms together would produce

outlandishly misleading numbers.

• The number of sites listed changes substantially from month to month as many,

or perhaps most, units are not available on a regular basis.

• Research on short-term lodging is only now beginning to get the attention of

major research firms and the academic world. To have accurate lodging figures,

the research firms would need the databases of the major short-term lodging

firms in order to eliminate duplication of housing units. Achieving that on a

national scale is a daunting exercise.

• Each of the major short-term lodging firms keep its statistics on different models

and often prefer not to share the data with independent research firms.

• The major short-term lodging firms have different market strategies. For instance,

HomeAway only rents “entire homes” while Airbnb rents entire homes, private

rooms and room-sharing.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 18 of 36

Section 4-1: The Size of the Local Short-Term Lodging Market

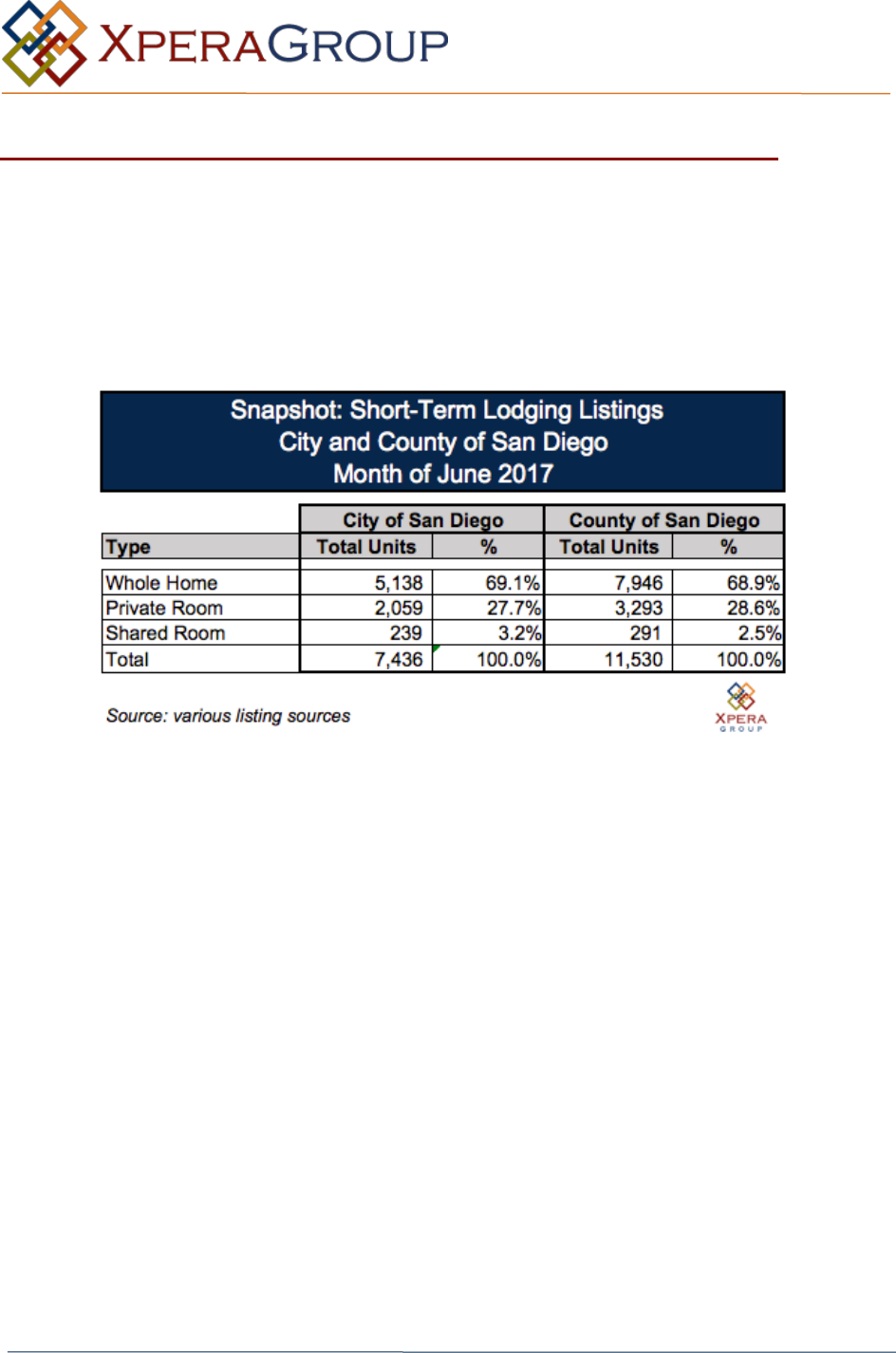

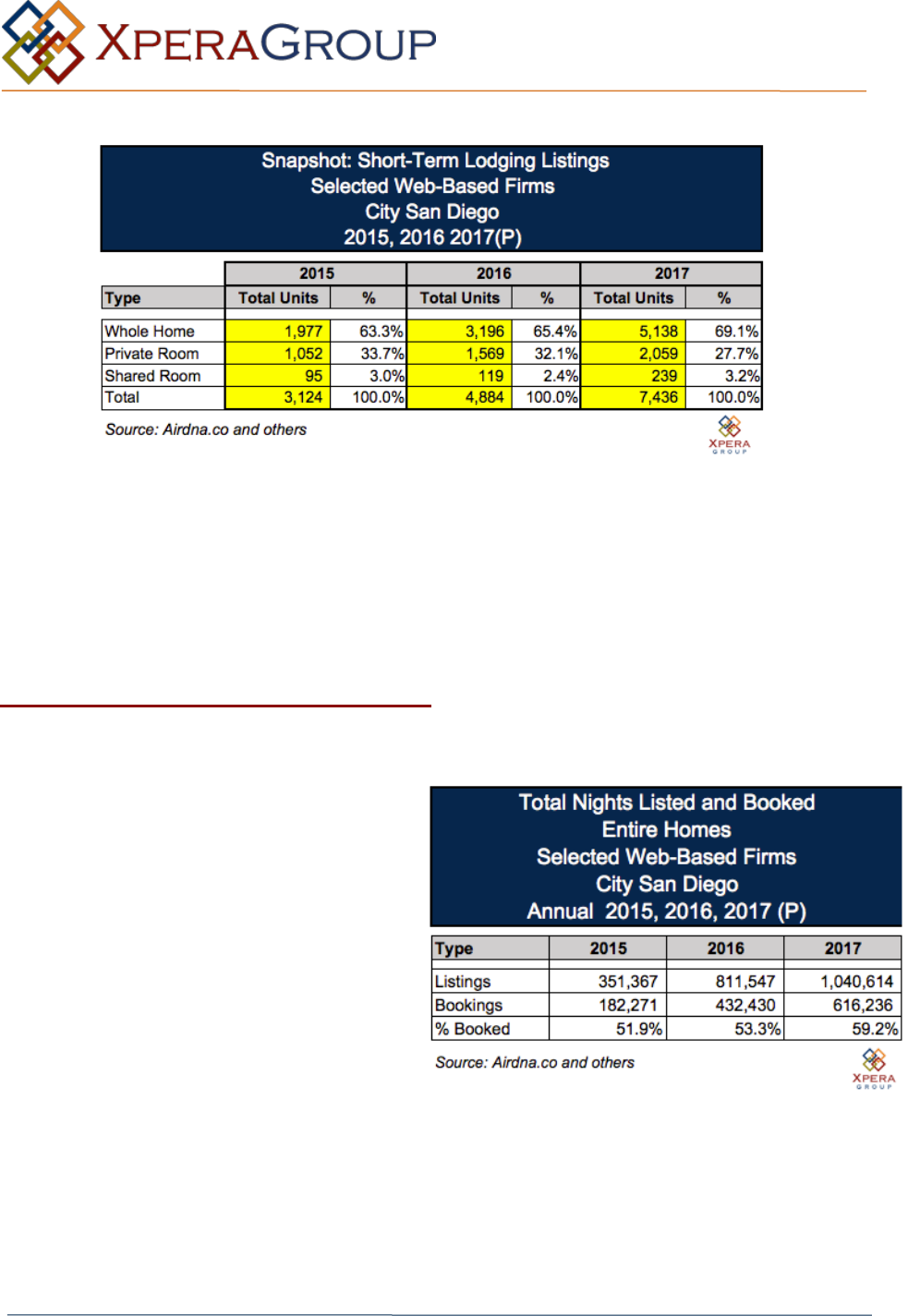

On the following exhibit, we show the estimated total number of short-term lodging

“listings” for the month of June 2017 for both the City of San Diego and the County.

Two-thirds of the listings are in the City of San Diego.

Also, two-thirds of the listings are for entire homes (detached or attached).

Exhibit 12

Note: Estimated active short-term rental users in the City of San Diego with at least three bookings

in the most recent calendar year. Estimates multiple listings and duplicates have been removed.

We can also note that the industry is changing. The private room and shared room

lodging is declining as a percent of the business of the major web-based lodging firms.

In this exhibit, we show the percentage of listings on short term lodging firms for the

months of June in 2015, 2016 and 2017. The “whole home” listings as a percent of the

total are nearing 70%.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 19 of 36

Exhibit 13

Note: Estimated active short-term rental users in the City of San Diego with at least three bookings

in the most recent calendar year. Estimates multiple listings and duplicates have been removed.

Also notable is the more than doubling of listings between 2015 and 2017 in all three

lodging categories.

We are unable to project the continuing trajectory of this pattern but suspect the short-

term lodging market will continue to grow.

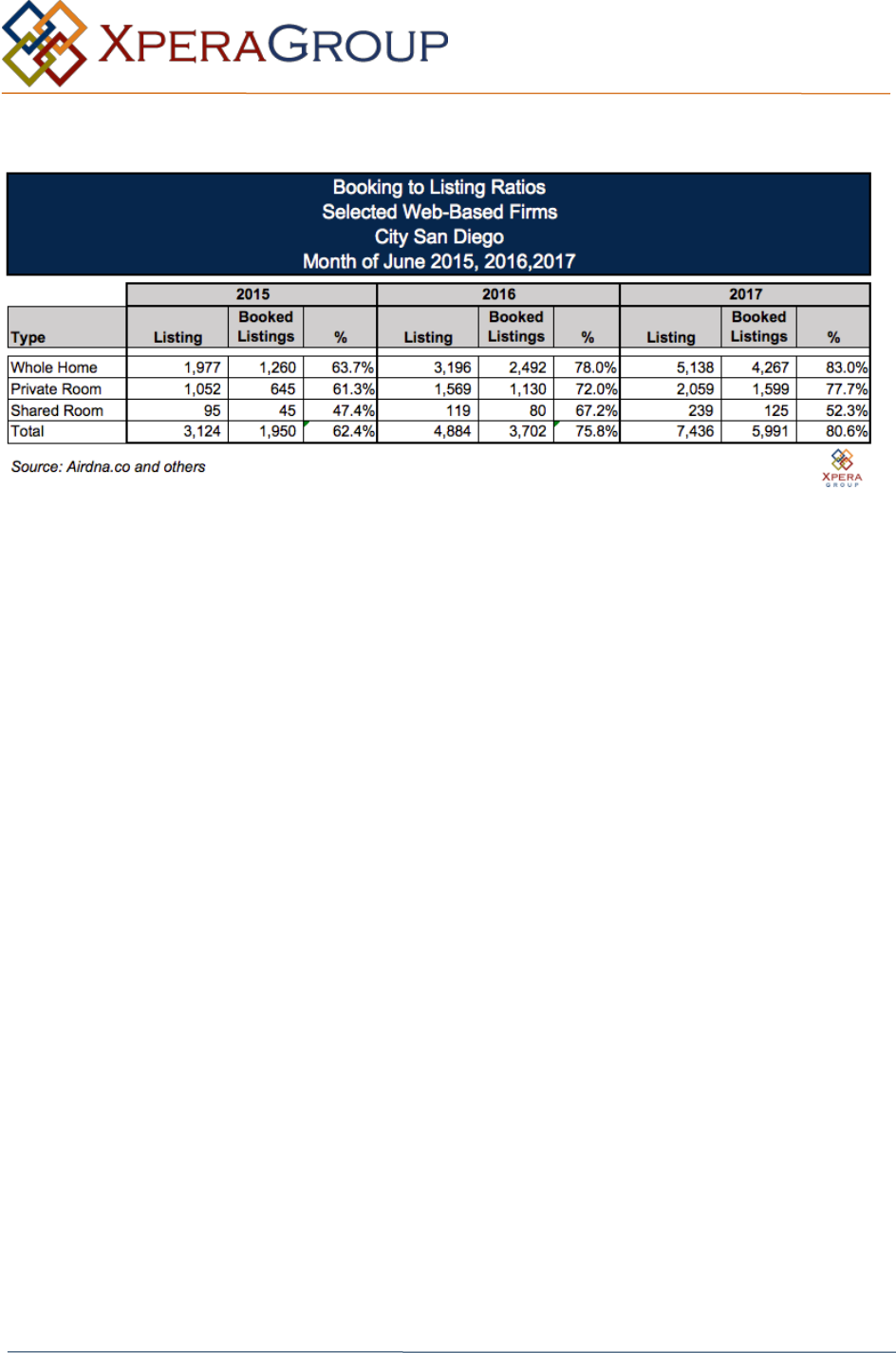

Section 4-2: Listings and Bookings

In the City of San Diego, the number of

listings of entire homes is anticipated to

pass the million level in 2017, resulting in

more than 600,000 bookings. The

bookings to listings ratio continues to

increase and is now approaching 60%.

Taking a snapshot of the listings and

bookings in the month of June in 2015,

2016 and 2017, it is evident that the

volume of both bookings and listings

continues to increase, but also the

percent booked is accelerating. We have

projected that in 2017, some 80%

of listings will be booked. Note: Estimated active short-term rental users in the

City of San Diego with at least three booking in the

most recent calendar year. Estimates multiple listings

and duplicates have been removed.

Exhibit 14

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 20 of 36

Exhibit 15

Note: Estimated active short-term rental users in the City of San Diego with at least three bookings in the most recent

calendar year. Estimates multiple listings and duplicates have been removed.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 21 of 36

Section 4-3: Conclusions on Number of Homes in the Short-term

Lodging Market in the City of San Diego

During the course of this study, we have been in contact with HomeAway, Airdna.com

(a short-term lodging research firm) and short-term lodging rental firms.

Based on our research, we estimate that the total number of “entire” short term lodging

housing units (homes and condominiums) that are in the City of San Diego at the

present time is in the range of 5,000-7,500.

This range is based on the assumption that HomeAway, VRBO and Airbnb rentals

(eliminating duplication of listings with other web-based services) represent 70-80% of

the total short-term rental homes available in the City of San Diego.

Also taken into account, but not documentable, are the number of homes that are only

in the short-term lodging business for part of the year. One of our sources who

specializes in beach rentals said that many of their listings are vacation home owners

who only use the home a few weeks a year and occasionally rent the homes for short-

term lodging. For that reason they are not and have not been part of the traditional

housing market.

In the unincorporated area of San Diego County, we learned that in fiscal year 2016-

2017 the County collected TOT on 243 residences. The City of San Diego was unable

or unwilling to provide us with that same information.

We also assume that most of the listing inventory is in the lands that straddle the I-5

between Ocean Beach and La Jolla.

On balance, our research indicates that in the City of San Diego, approximately

1.0% of the home and condominium inventory is devoted to short term lodging.

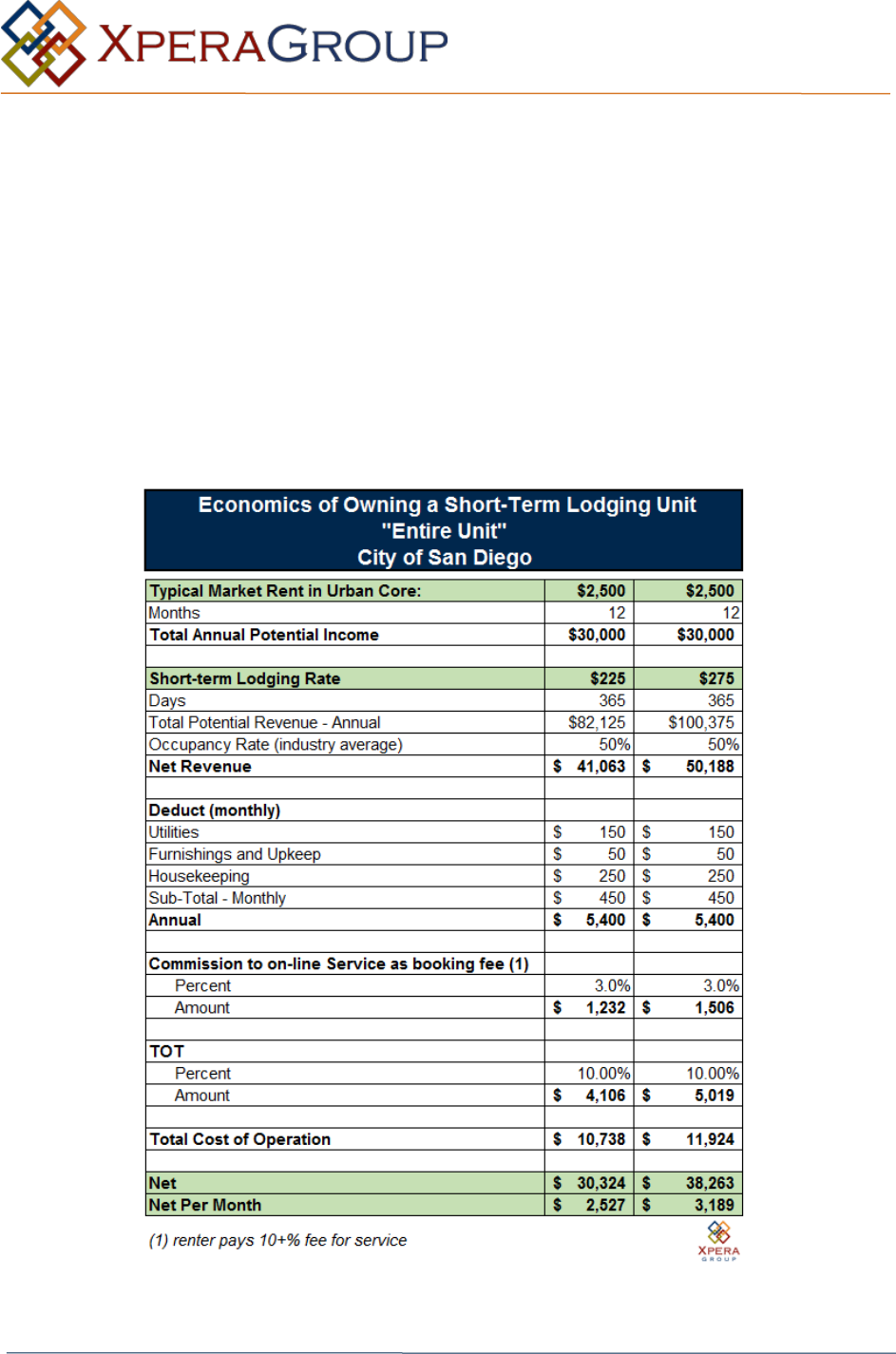

Section 4.4: The Economics of Short-Term Lodging for an

Owner/Lessor

An owner must calculate the profitability of operating a residential unit as a year-round

short-term lodging accommodation.

It is one option to lease out your residence while you are on a vacation, but yet another

if you are to devote a residence to full-time short-term lodging.

Our analysis indicates that a residence becomes profitable as a short-term lodging

business if the rents can be high enough and if a unit can be occupied more than the

industry average of 40%.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 22 of 36

In metropolitan areas where hotel rates and occupancies are high, and that the

residence is well-located, it is logical to assume that it will be possible to far exceed the

40% average and obtain the rents necessary to be profitable.

Recent research has indicated that owners of second homes in strong locations are

increasing as a percent of the total short-term lodging market.

Thus, based on our pro-forma below, on a year-round basis, it would be necessary to

achieve an average rent of up to $275 per night with a 50% year-round occupancy in

order to match or exceed the rent the unit could obtain as a traditional rental unit. In

most locales, we believe that level of rent would be difficult to obtain on a year-round

basis.

Exhibit 16

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 23 of 36

Section 4-5: The Short-Term Lodging Conundrum: Pacific Beach

(92109)

We want to single out a discussion of Pacific Beach (92109). It is the most popular

beach resort for tourists visiting San Diego. It has, unfortunately, an extremely limited

number of hotel rooms.

The dearth of hotel rooms relates to a 1972 Citizen’s Initiative that placed a 30’ foot

height limit on construction in the beach areas. As a result, the only two hotels of

substance in the Pacific Beach area are now 40+ years of age and preceded the

Initiative.

As a result of the dearth of modern hotel space near the beach, a substantial portion of

the housing inventory (homes, apartments and condominiums) is rented out to

vacationers. Some of the units are rented from September through May as regular

apartments but are then available only for summer guests at summer short-term rates.

We have been unable to document the percent of housing units in this category.

Theoretically, TOT is paid on units rented for less than 30 days, but the documentation

is sparse.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 24 of 36

Section 5: The California and San Diego Tourism/Hotel Market

In Section 5, we discuss the travel and hotel markets in both the state of California and

San Diego County.

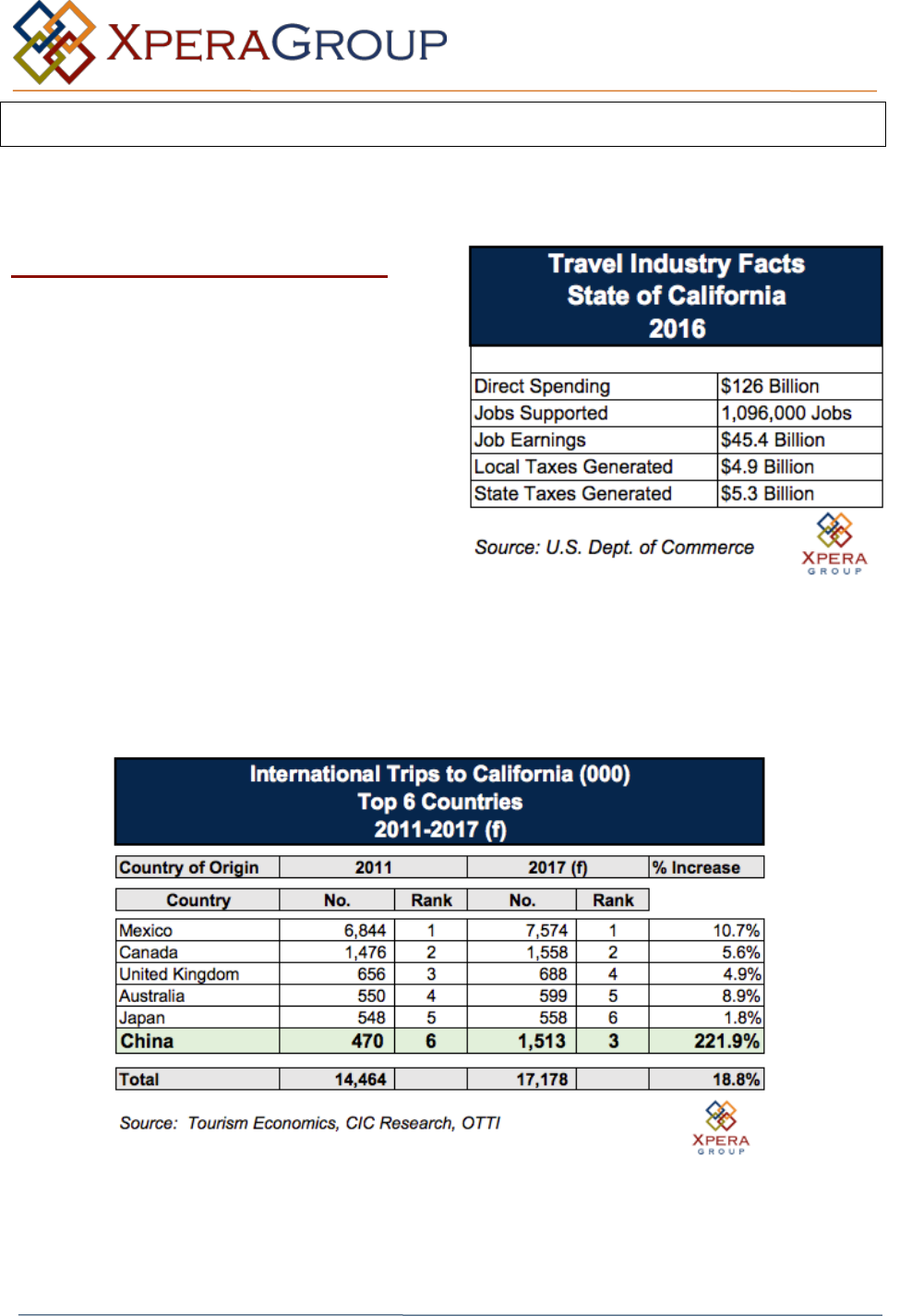

Section 5.1 Travel in California

California tourism is an industry of

enormous proportions. In 2016, it is

estimated to encompass spending of $126

Billion, directly support 1.1 million jobs with

earnings of $45.4 billion and generate $4.9

billion in local taxes and $5.3 billion in state

taxes.

California ranks as the number one state for

foreign tourism. As in the past, Mexico is

first in trips to California with Canada in

second place both in the 2011 and 2017

survey. The major surprise is the substantial increase in visitors from China. This year it is

forecasted that the number of visitors to California from China will match the total from

Canada and move into third place for visitations.

Exhibit 18

Exhibit 17

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 25 of 36

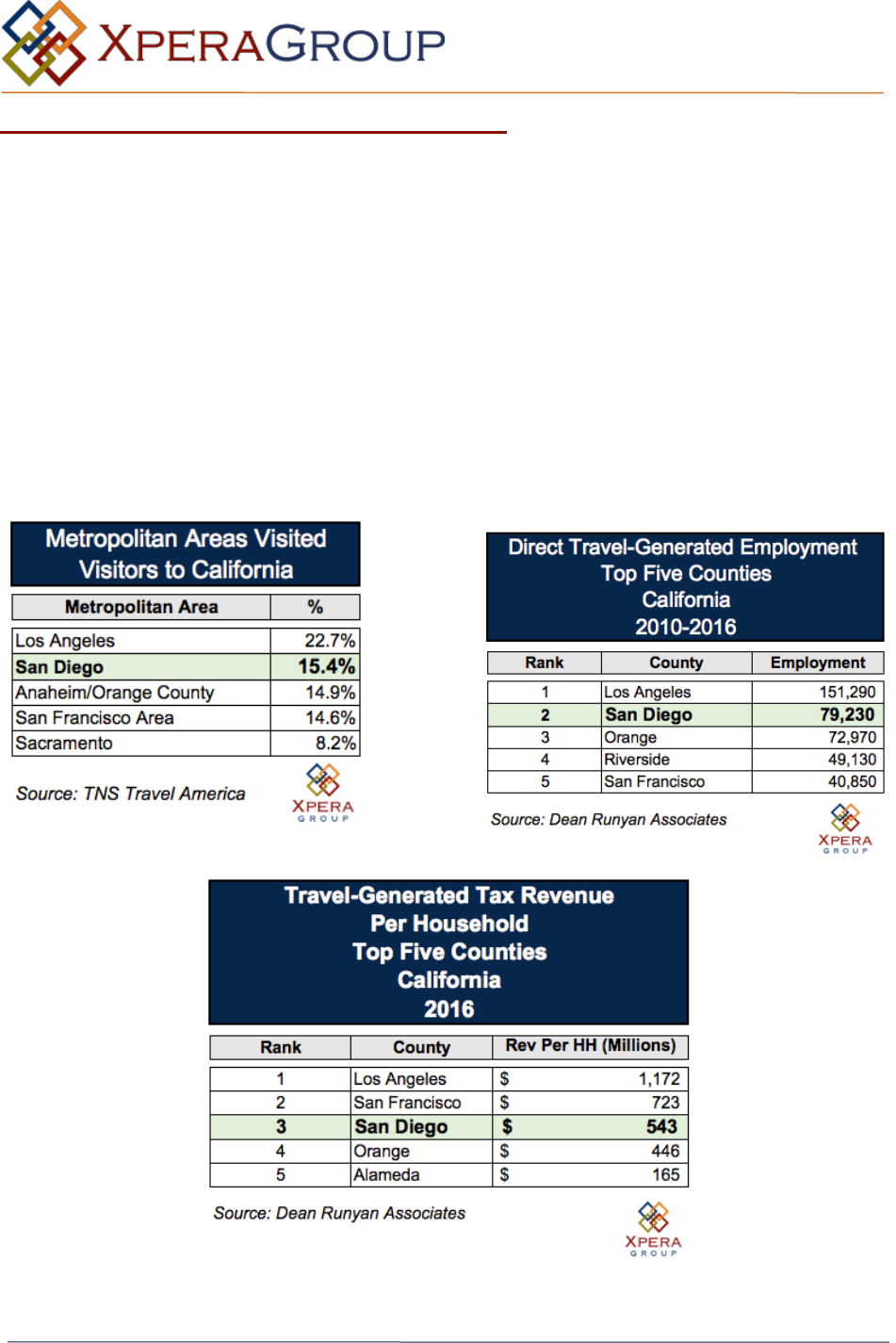

Section 5.2: San Diego Tourism Ranking

Within California, San Diego County is the second most popular metropolitan area

visited, with Los Angeles in first place and Anaheim/Orange County and the San

Francisco Area in third and fourth place.

As with metropolitan areas visited, San Diego ranked second in direct travel-

generated employment, once again behind Los Angeles with Orange, Riverside and

San Francisco in third, fourth and fifth place, respectively.

In terms of travel-generated tax revenue per household in California, San Diego ranked

third with $543 dollars per household. In this category, Los Angeles is in first place with

San Francisco in second place. San Diego was followed by Orange and Alameda

Counties in fourth and fifth place.

Exhibit 19

Exhibit 20

Exhibit 21

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 26 of 36

Section 5.3: Total Visitations and Economic Impact to San Diego

County

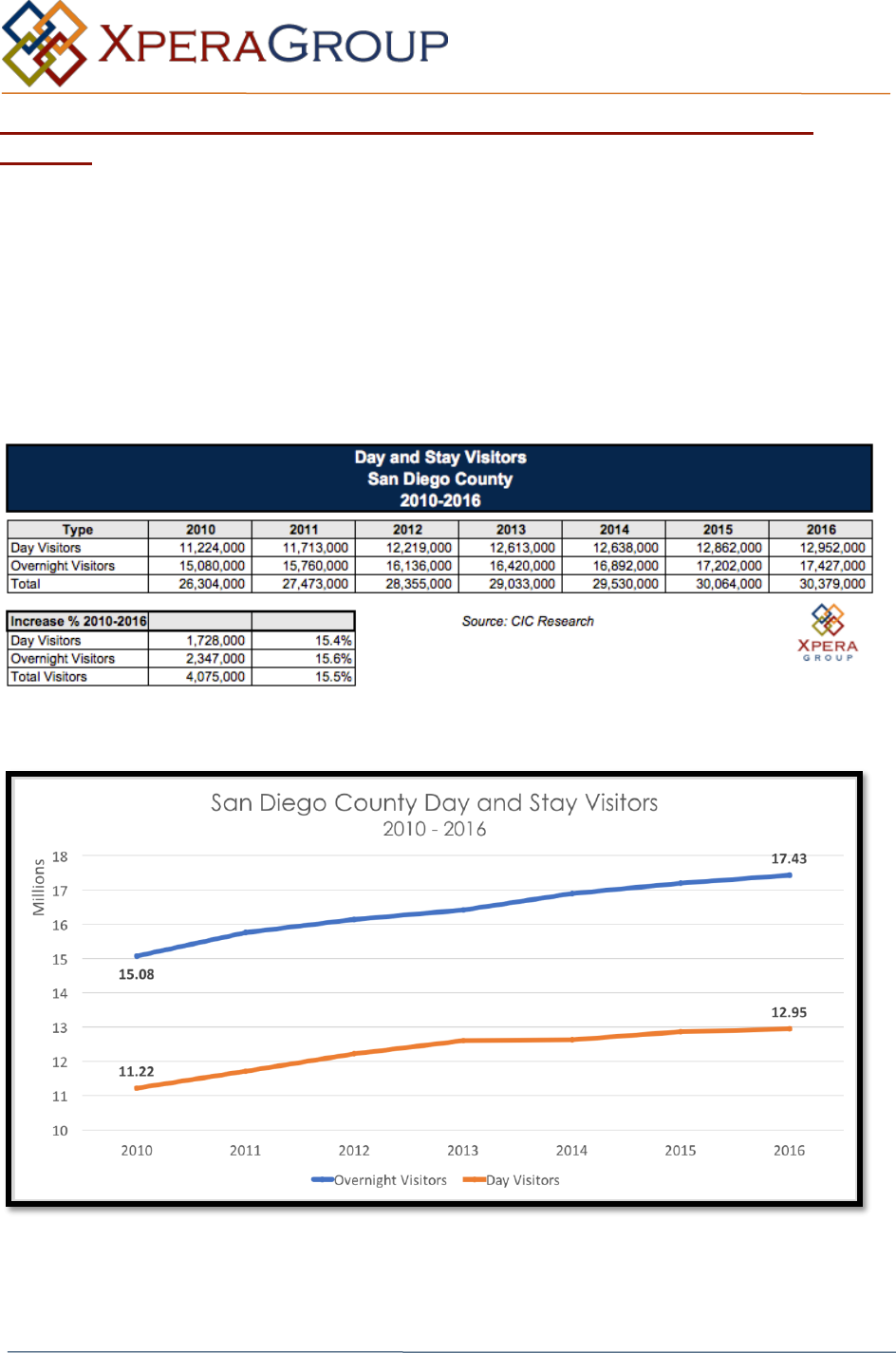

CIC Research prepares annual studies of visitations to San Diego County. They

segment the count into day visitors and overnight visitors.

In 2016, they estimated a total of 30.4 million visitors, 17.4 million, or 57% of whom

lodged overnight. Between 2010 and 2016, the visitor count increased by 4.0 million, or

15.5%. It is important to note that the increases have been steady, with gains each year

since 2010.

Exhibit 22

Exhibit 23

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 27 of 36

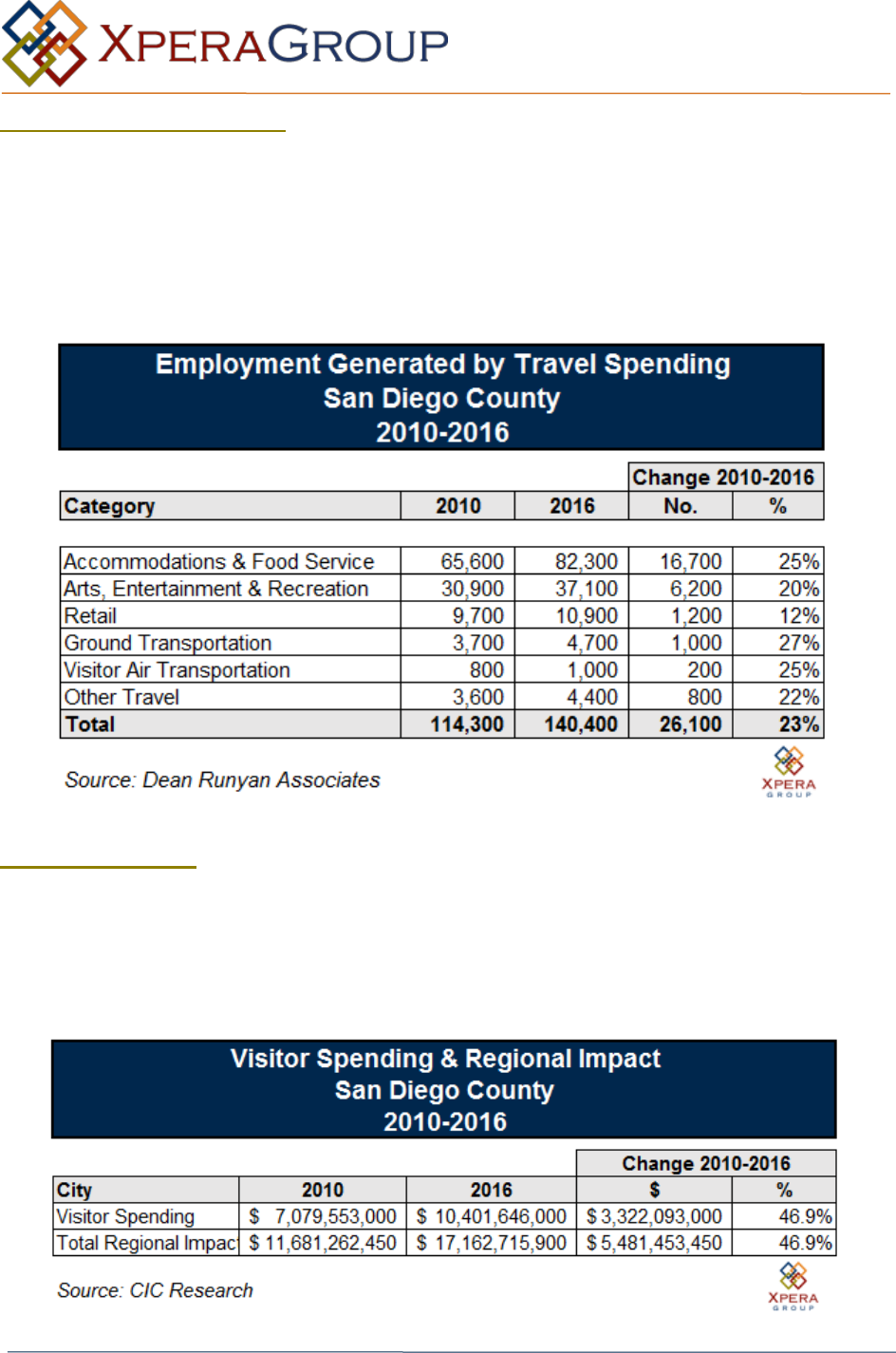

Employment Generation

Based on a study by Dean Runyan Associates prepared for the state of California,

140,000 jobs were generated by the tourism industry in 2016, an increase of 23% since

2010. The largest single category was “accommodations and food service”, accounting

for 58.6% of total employment generation.

Exhibit 24

Visitor Spending

CIC Research has calculated that visitor spending in San Diego County in 2016 was

$10.4 billion, a highly positive change of almost 50% since 2010. Similarly, the regional

impact of $17.2 billion in 2016 is anticipated to increase by a like percentage in 2017.

Exhibit 25

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 28 of 36

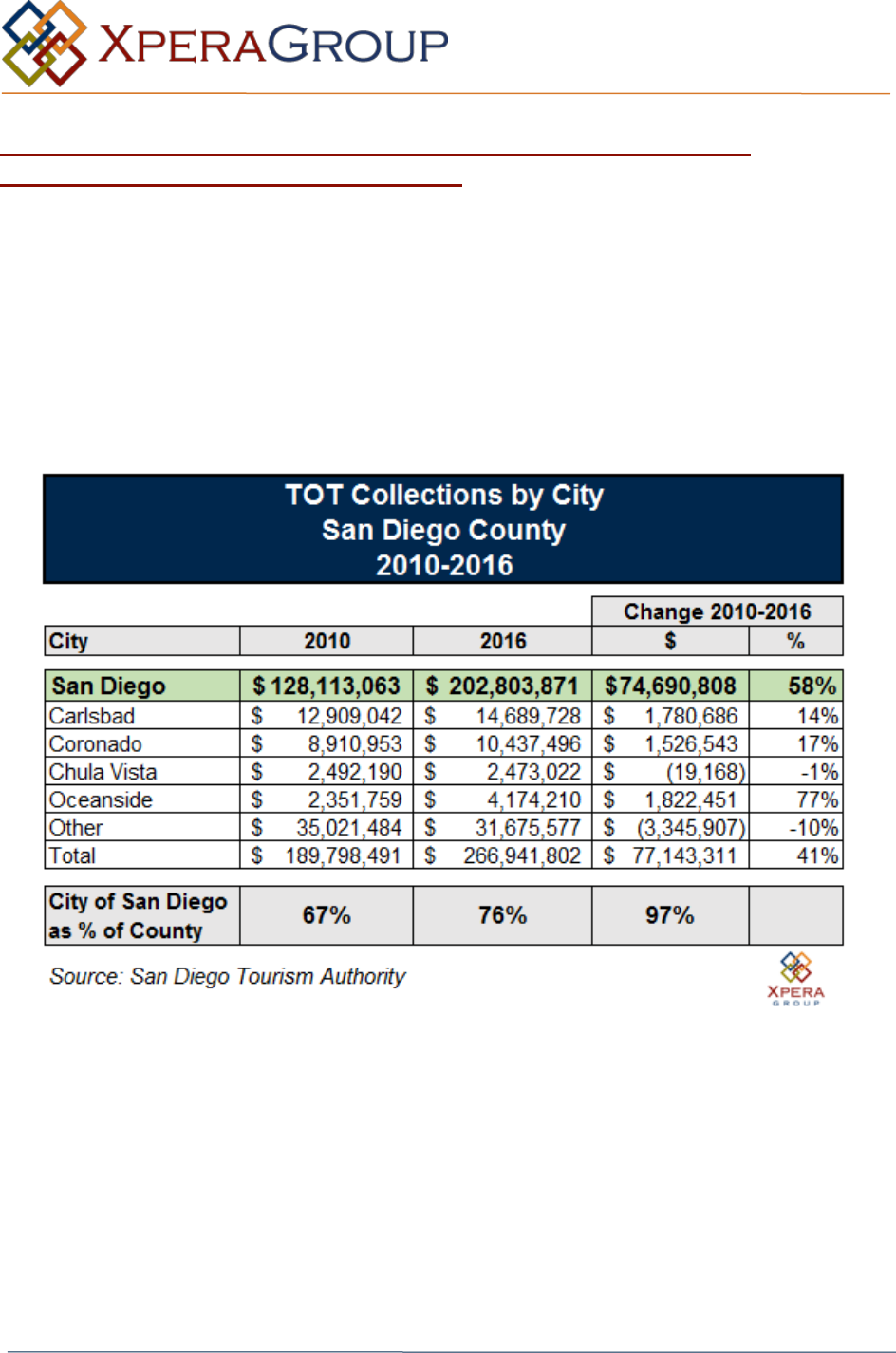

Section 5.4 Transient Occupancy Tax Collections and Hotel

Occupancy and Revenues per Room

Transient Occupancy Tax (TOT) is levied on long and short-term accommodations in

most cities of San Diego County. In total, the County collections totaled $266.9 million in

2016. Of that total, 76% of the collections were in the City of San Diego.

In the City of San Diego, in 2016, TOT totaled $202.8 million. Of perhaps the most

interest is that of the total TOT gain Countywide from 2010 to 2016, 97% was in the City

of San Diego

Exhibit 26

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 29 of 36

Hotel Occupancy and Rates

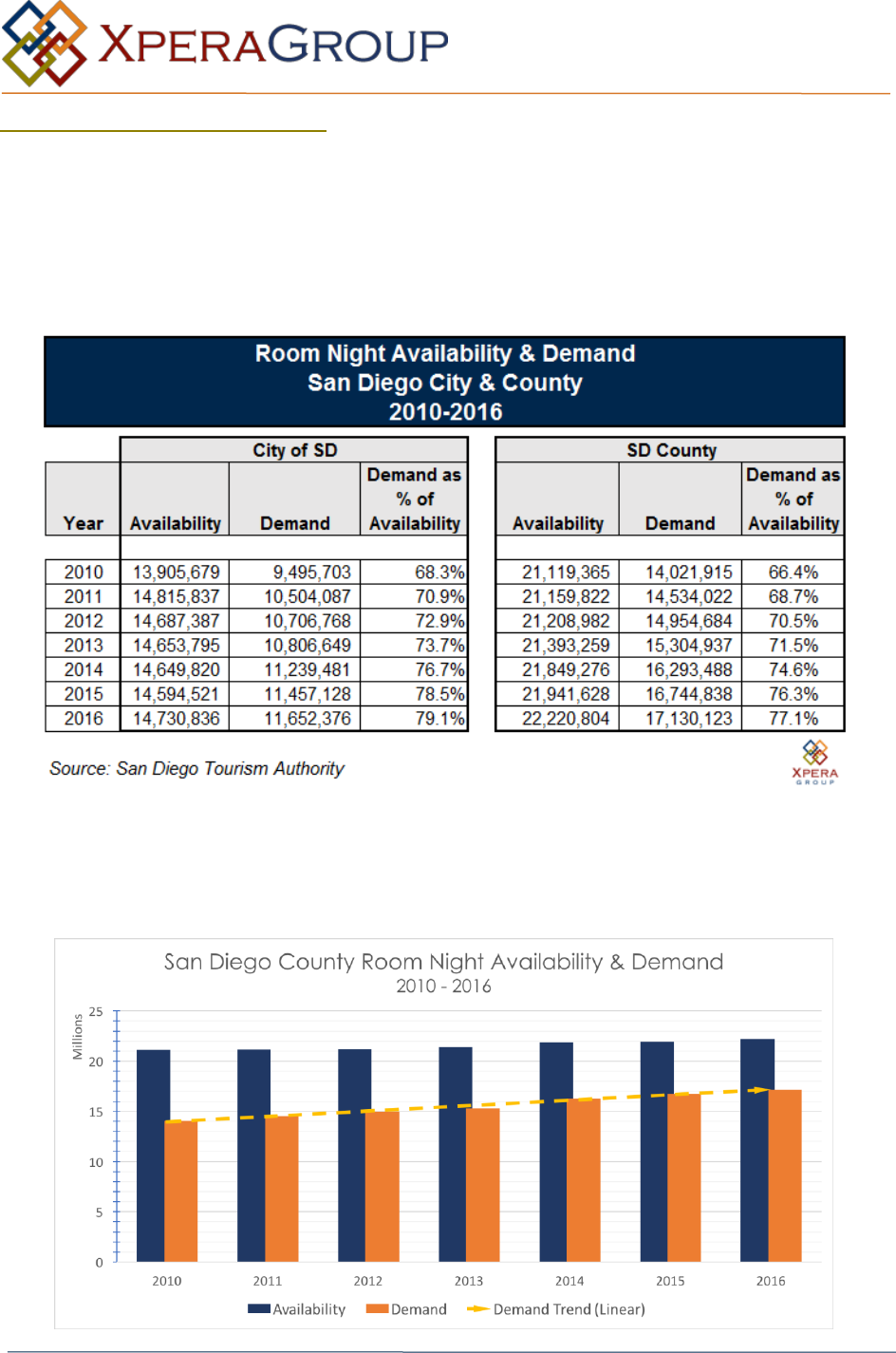

The hotel market in San Diego County is one of the strongest in the Nation, with

occupancy rates second only to Las Vegas. In 2016, average occupancy rates

Countywide were 77.1% and higher, 79.1% in the City of San Diego. Of equal

importance, occupancy rates have continued to climb in each year since 2010.

Exhibit 27

In 2010, in the City of San Diego, occupancy rates were 68.3% and have climbed to

79.1% in 2016.

Exhibit 28

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 30 of 36

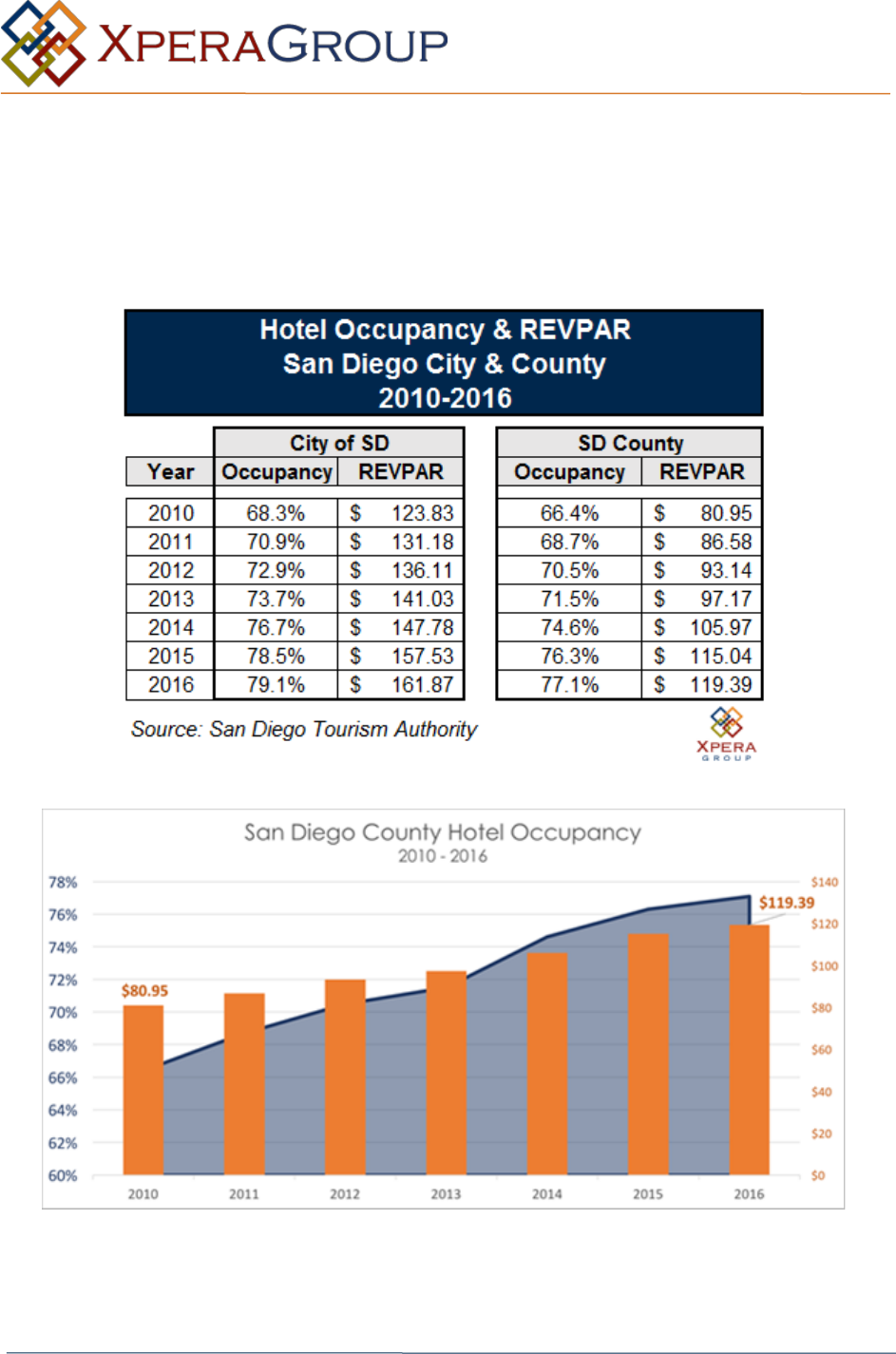

Of equal importance, REVPAR (revenue per room) has continued to climb in both the

County of San Diego and the City of San Diego. Since 2010, in the City of San Diego,

REVPAR has moved upward from $124 per night to $162 per night in 2016, an annual

gain of 6.1%, far outpacing the inflation rate (CPI) in the same timeframe.

Exhibit 29

Exhibit 30

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 31 of 36

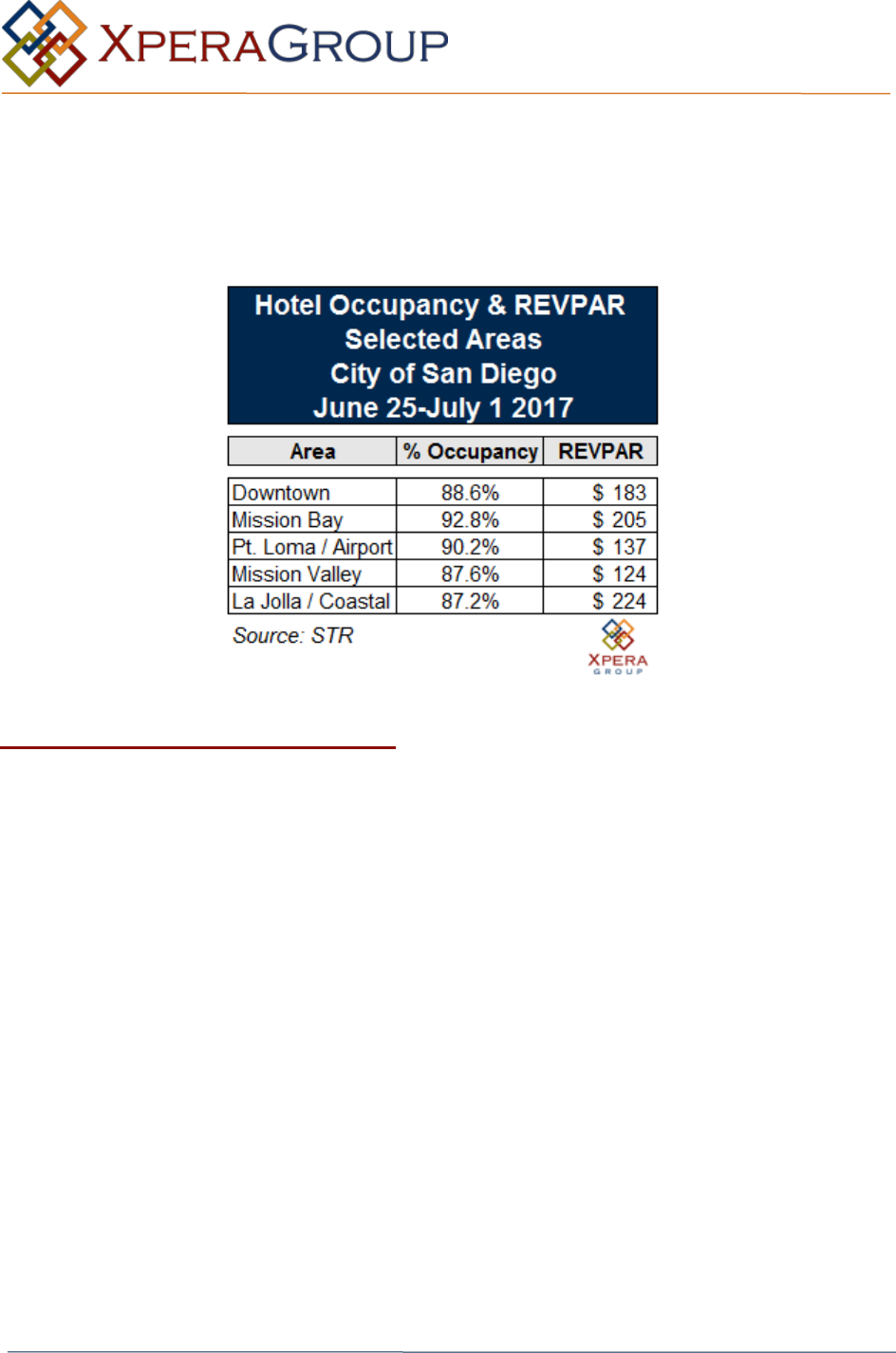

In downtown and near the coast, REVPAR was substantially higher than the city-wide

and County-wide averages, as shown here:

Exhibit 31

Section 5.5: Hotel Construction

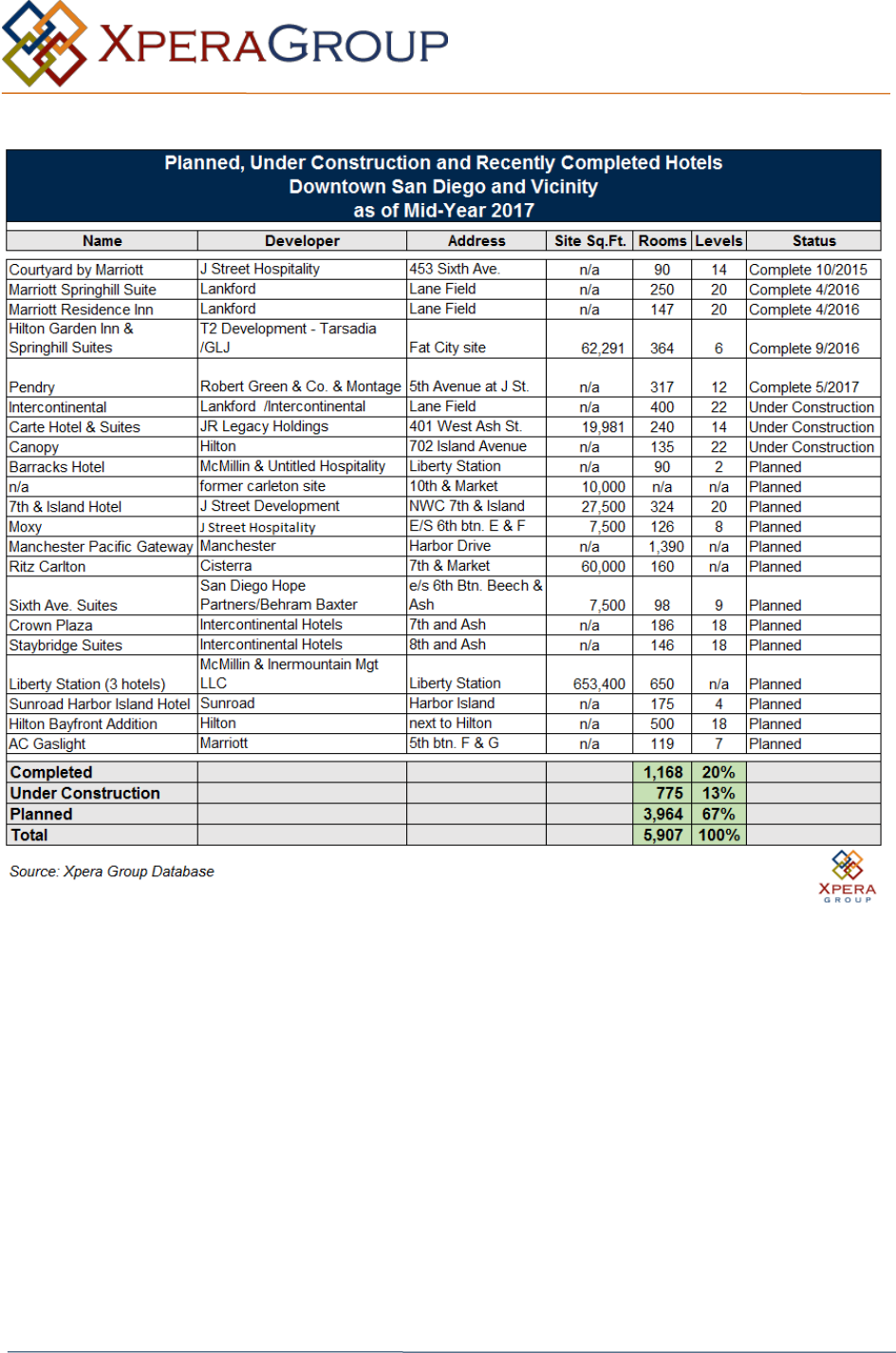

Given the continually high occupancy and growing REVPAR, hotel developers have

sensed the need for more hotel space in San Diego.

In the following exhibit, we show the hotels that have been completed in the downtown

area since 2015 as well as those under construction and in planning.

In total, 1,168 rooms have been completed since 2015, with another 775 rooms under

construction and 3,964 rooms in planning.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 32 of 36

Exhibit 32

In addition, there are hotels that have been recently completed, under construction and

in planning elsewhere in the County, mostly in those communities straddling the I-5

freeway and/or at the casinos.

The County has an almost complete dearth of hostels and other moderate priced

visitor lodging. As a result, short-term rentals have become a partial substitute

for that visitor lodging type in San Diego.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 33 of 36

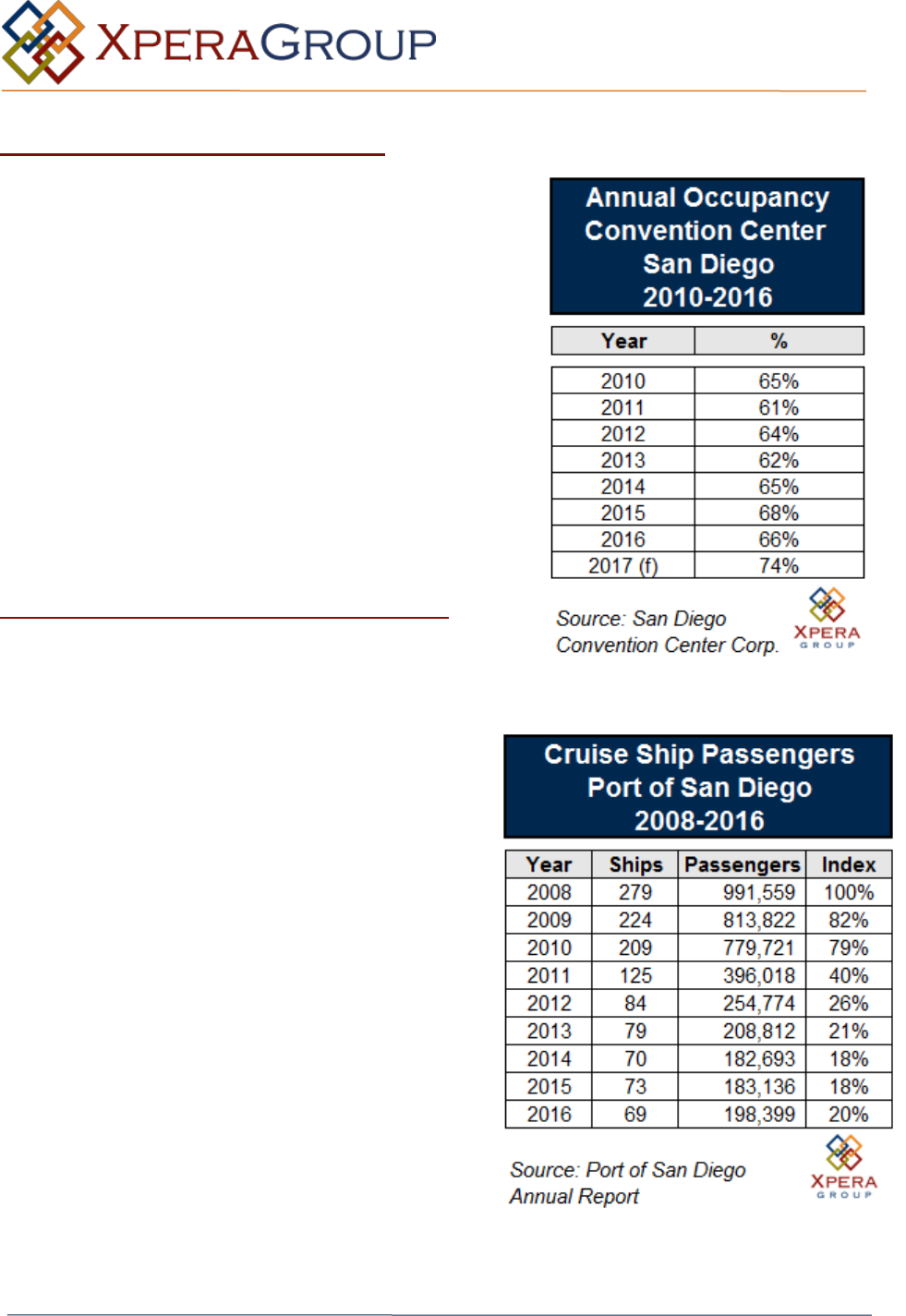

Section 5-6: Convention Center

The City of San Diego’s convention center maintains

one of the highest occupancy rates in the Nation with

a 74% occupancy rate projected for 2017. The rate of

occupancy has steadily climbed each year since

2010.

A third phase of the convention center is in planning

although the completion date is not certain. The third

phase will allow San Diego to compete for the larger

National conventions and, of course, create

substantial additional demand for accommodations of

all types.

Section 5.7: Cruise Ship Passengers

It is highly likely that the hotel occupancy rates would

be higher than they are today if the cruise ship

business has not dissipated in the past few

years, as many of the passengers extend their

vacations by visiting San Diego either before or

after their cruise.

In 2008, San Diego hosted almost 1.0 million

passengers. Most of their cruises were Mexican-

bound. In that timeframe, there was

considerable press about drug-related murders

and other assorted crimes in Mexico. As a

result, the cruise ship business plummeted 80%

to a low of 182,693 passengers in 2014 and has

now stabilized and is very gradually increasing.

As that business returns, it will drive higher

occupancy in the downtown and coastal hotels.

Exhibit 33

Exhibit 34

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 34 of 36

Methodology

The methodology used in this report closely follows that of the National University study

from 2015. We did have the benefit of data that was not previously available as a result

of newer data-collecting methods and a broader range of research sources.

The most difficult research relates to accurately determining the number of available

short-term lodging facilities and their percent of utilization. We relied substantially on

HomeAway, Airdna.co and Airbnb for input data on that subject. We are confident that

our findings are statistically accurate within ranges of data, but hesitate to put “exact

numbers” on the findings.

In recent years, the number of on-line services that provide short-term lodging facilities

has expanded exponentially as have the number of persons using those on-line

services, as room-sharing and private-room loading have become more acceptable and

have therefore allowed a far larger segment of the population to vacation with modest

budgets.

Data on spending is not an exact science, but we did have several sources that led us

to what we consider realistic findings. In many cases, we know we understated

spending for non-hotel items like food and beverages. We were not able to determine

accurately spending on such venues as gaming casinos or other major event spending

like horse racing, Legoland, SeaWorld or the Zoo, or, for that matter, a day at

Disneyland or Tijuana.

We also estimated that 75% of non-lodging expenditures would be within the City of

San Diego. That conclusion is logical but certainly not result from scientific

methodology.

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 35 of 36

Xpera Group

Xpera Group is the West Coast’s most comprehensive team of construction consultants

and strategic advisors for the built environment. Having started as a construction

forensics firm in 2009, we have expanded our offerings over the years to deliver

specialized expertise to clients at all phases of the development process.

Having assembled more than 50 highly experienced construction professionals in

virtually every specialty trade, we are uniquely qualified to serve a wide range of clients,

including contractors, developers, legal and insurance professionals, and property

owners.

We are able to customize service solutions to meet each client’s unique goals, whether

it’s ensuring quality standards, avoiding costly construction delays and claims, or

achieving successful resolution for troubled projects. Quite simply, we are the

construction industry’s problem-solvers and your partners for construction success.

Economic Research Division

In today’s world, gathering the statistical data for a market research report is the easy

part. Achieving a deeper understanding of the various market forces at play on a

specific project requires a more sophisticated approach.

Xpera Group’s economic research division is led by Alan Nevin, one of the West

Coast’s leading real estate economists. With decades of proven experience in both

economics and real estate development, he specializes in producing market strategy

studies, which represents a major departure from traditional market research reports.

What is the distinction? Most market research reports include a multitude of pages filled

with statistics on the economy and market, followed by brief conclusions and a

summary of project recommendations. What is inevitably missing is the most critical

element–the strategy and analysis that connect the statistics to the recommendations.

That’s where we shine.

Having performed over 1,000 market studies across the United States and as a former

chief economist for the California Building Industry Association, Nevin is uniquely

positioned to help ensure your project has the best strategy for success.

Economic & Market Research Studies

• Feasibility Studies for residential and commercial development

• Economic Overviews, Forecasting and Trending – Major Metropolitan Areas

• Residential and commercial property valuations

• Fiscal impact reports

• Public sector redevelopment area strategies for growth and repositioning

10911 Technology Place, San Diego, CA 92127 |858-436-7770 | www.xperagroup.com

Page 36 of 36

Litigation Support

• Expert Witness – Deposition and Trial Testimony for: Valuation, Damages,

Proper Professional Practices and Industry Standards

• Supporting Research & Analysis – Assist Attorneys in Case Strategies, Asset

Valuation, Calculated Damages, Financial Feasibility and Proforma Analysis,

Market Trends and Conditions

• Mediation – Negotiate Settlements on Real Property Disputes, Negotiate

Settlements for Damages and Loss of Value

Real Estate Advisory

• Succession planning for families and businesses

• Developing strategies on real estate holdings to meet changing goals

• Dissolution of marital assets and allocation of holdings

• Analysis of portfolios and strategies for the future

• Valuation of investments, properties in development and limited partnership

interests