April 2022

The Federal Grant Budget

3

April 2022

Developing a Federal Award Budget

Overview

Two important components of a federal award application are the budget and the budget narrative. This

guide provides step-by-step instructions on how to develop a federal award budget. The budget provides

the total cost for each category of the budget, while the budget narrative provides a breakdown of each

budget category and provides a justification for every item in the budget.

How to Create a Budget

The first step in creating a budget is determining what template to use. The Notice of Funding Opportunity

(NOFO) details if there is a required template to use for the budget and budget narrative. If the NOFO or

federal awarding agency does not require a specific template, use the organization’s budget template.

There is also an example template provided at the end of this guide.

When completing the budget, make sure to provide a clear justification for each itemized expense

included in the budget. Some federal agencies or subagencies provide guidelines on how to prepare an

application budget. For example, CDC’s Budget Preparation Guidelines provides guidance on preparing

a budget for submission to CDC.

A well-prepared budget should be reasonable and demonstrate that the requested funding will be used

wisely. The budget should be as concrete and specific as possible in its estimates. Make every effort to

be realistic and to estimate costs accurately.

When developing the budget, it is helpful to think of the who, what, when, where, why, and how for the

project.

The WHO of the budget consists of the people who will carry out the proposed work.

o Will they be full or part-time employees?

o How much of their time will be needed on the project?

o Some employees, usually administrative and support staff, have workloads spread

across multiple projects. In such cases, be sure no single employee is committing

more than 100% of their time across multiple projects.

o Ensure the proposed salaries are consistent with that paid for similar work within

the organization.

o Will consultants be needed to complete the work – individuals with a particular

expertise or skill set not available within the organization?

4

April 2022

The WHAT of a budget includes tangible items needed to carry out the proposed project.

o What type of supplies or equipment are needed?

o Will the equipment be purchased, rented, or leased?

o What type of operating expenses are needed?

The WHEN of the proposed project is important to consider when building the budget.

o Will the proposed project occur over one year or multiple years?

o When budgeting a multi-year project, consider cost of living increases for project

staff, equipment maintenance fees, and necessary software upgrades.

o Remember that all costs associated with the project must be incurred during the

project performance period as outlined in the Notice of Award.

The WHERE of the proposed project may include location, travel, and/or utility costs.

o Where will the proposed project take place?

o Will it occur in an office building? If so, will the grant need to cover a portion of the

facility rent or utilities? Or will the proposed project occur at another location? Or

maybe both? If including facility rent or utilities, ensure these costs are not already

covered in the organizational indirect rate.

o Will project staff need to travel as part of conducting the proposed project? Or is it

possible to conduct these meetings virtually?

o Will project staff need to acquire specialized training to deliver the project work?

The WHY is the budget narrative or budget justification.

o The budget narrative is a written version of the budget, which provides a

justification for all requested expenses. Be sure to clearly tie the expenses to the

narrative of the grant proposal.

o Why are these expenses necessary for development, implementation, and/or

continuation of the project?

o Are the expenses allowed on this project? Review the expenses that are exempted

(unallowable) under the terms of the award. For example, if equipment is exempt,

do not include expenses in that budget category. The applicant can review the

exempted expenses in the Notice of Funding Opportunity (NOFO).

5

April 2022

The HOW of the budget explains how the cost for each requested item was determined.

o Is the requested consultant using comparable market rates for their services? Did

the applicant shop around to find a reasonable cost for the requested supplies?

o The how of the budget also centers on sustainability. Granting agencies might

consider their awards to be “seed money,” start-up costs to get a project off the

ground. Funders will commonly ask in the proposal narrative how the agency

plans to support the proposed project after the grant has ended.

Matching Costs

Some grants also require matching funds to be included in the budget as a forecast of the proposed

project’s sustainability. Matching funds are dollars from a source other than the grant which will support

the proposed project. Match usually is provided by the potential grant recipient. Match can either be

hard match or soft match. Hard match is cash, i.e., an employee working on the project who will be paid

from another source. Soft match is in-kind. In-kind match may be something like the reasonable rent

value of the space used to deliver the proposed project.

Direct vs. Indirect Costs

There are two types of costs included in your budget: direct and indirect costs.

• Direct Costs: A cost or expense that can be specifically assigned to a particular project, program,

or activity.

Example: Salaries for staff working on the project, supplies and travel costs

required for the project, and any contractors working on the project.

• Indirect Costs: Also known as Facilities and Administrative (F&A), indirect costs cannot be

assigned to a particular project but are necessary for the operation of the organization and

therefore the performance of the project.

Example: Administrative staff not directly supporting the project but who

support the operation of the organization (e.g. legal and finance

departments), building utilities and rent, and accounting costs.

6

April 2022

TIP: Always ensure the division between direct and indirect costs are not in conflict. For example,

if the organization’s indirect rate includes utility costs, the applicant cannot also request

compensation for utility costs on their budget.

How to Calculate Indirect Rates & Costs?

To claim indirect costs, the applicant must either use:

1) A current, signed Negotiated Indirect Cost Rate Agreement (NICRA) established with a cognizant

federal agency or,

2) If the organization does not have a current NICRA or has never had a NICRA, the applicant can

use the De Minimis Rate.

NICRA: The NICRA provides an approved indirect cost rate that an organization can apply to federal

awards. The applicant can elect a lower indirect rate, if needed, but can never request a higher indirect

rate, on a budget, than their NICRA.

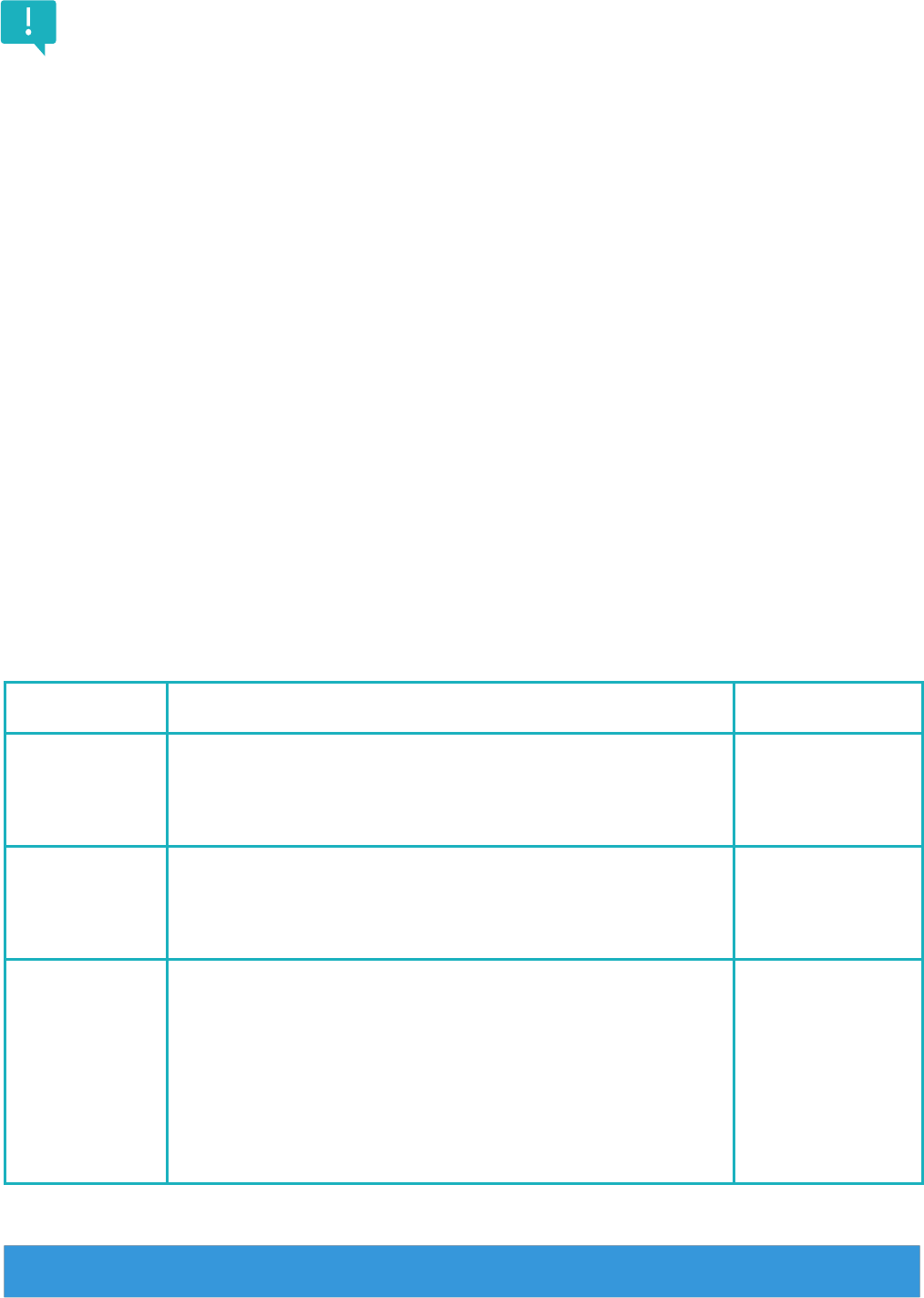

To obtain an indirect cost rate, a grantee must submit an indirect cost proposal to its cognizant agency

and negotiate an indirect cost agreement. The federal agency that provides the most funding is the

cognizant agency responsible to establish indirect cost rates. The cognizant agency will provide the

procedures on applying for an indirect cost rate. The table below provides more information for each

type of indirect cost rate.

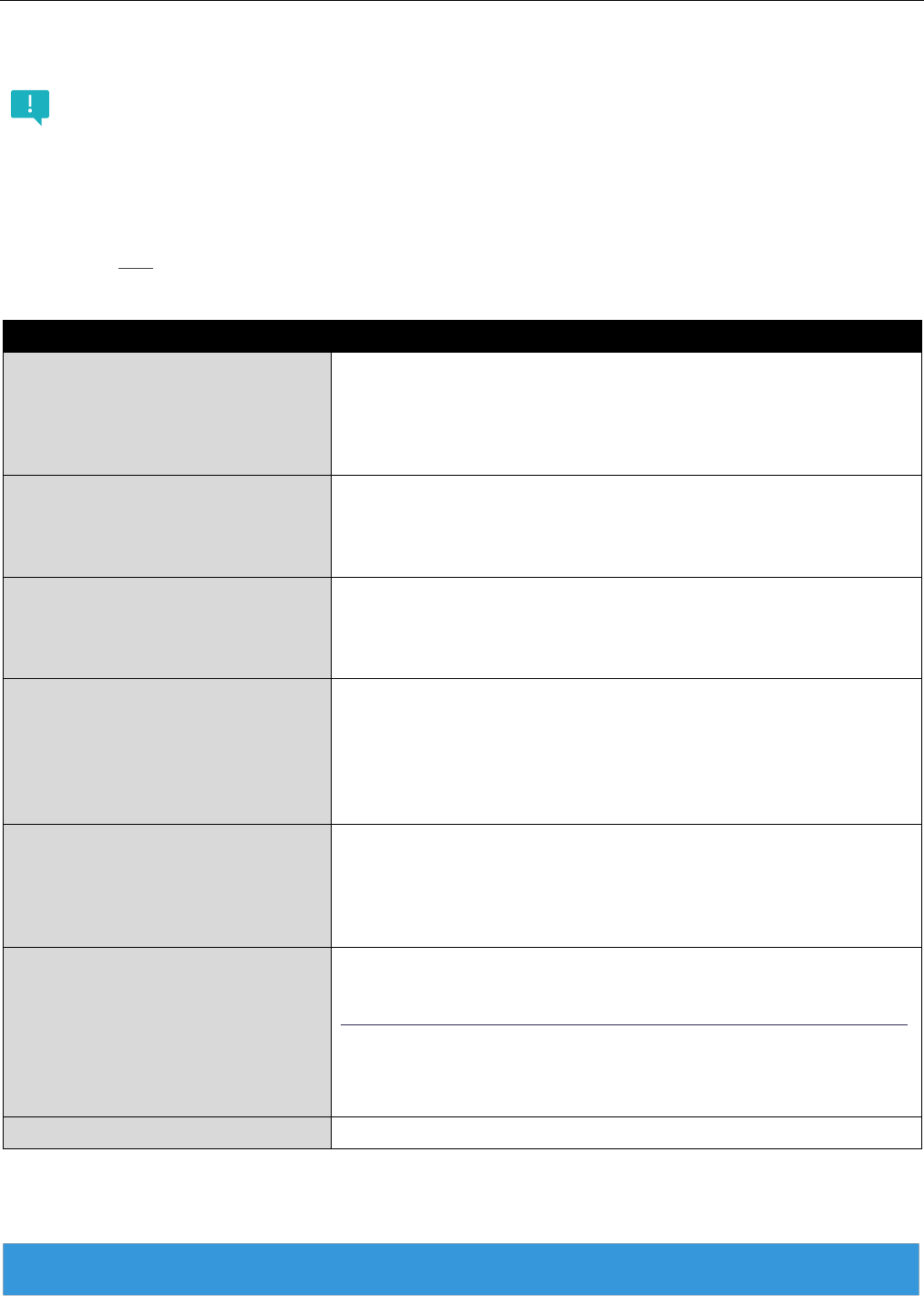

NICRA

DESIGNATION

DESCRIPTION

RENEWAL

Provisional

A provisional rate is a temporary rate established for a given

period of time to permit funding, claiming, and reporting of

indirect costs pending establishment of a permanent rate for

that period.

Upon completion

of the Grant/

Contract period

Predetermined

A predetermined rate is a permanent rate established for a

specific future period based on a review of actual costs from

a preceding period. These rates are not subject to

adjustment except under very unusual circumstances.

Two to five years

Fixed

A fixed rate has the same characteristics as a predetermined

rate; however, the difference between the costs used to

establish the fixed rate and the actual costs incurred during

the fiscal year covered by the fixed rate is classified as a

carry-forward. The carry forward is used as an adjustment to

the current rate to allow the Grantee/Contractor to either

recover under recovery or pay back an over recovery in a

subsequent year.

Two years, then

annually thereafter

7

April 2022

Final

A final rate is a permanent rate established after an

organization’s actual costs for a current year are known. A

final rate is used to adjust indirect costs claimed based on a

provisional rate.

Typically, annually

De Minimus Rate: The de minimis rate allows the applicant to take up to 10% of the modified total direct

costs (MTDC) as indirect. MTDC includes all direct salaries and wages, applicable fringe benefits,

materials and supplies, services, travel, and up to the first $25,000 of each subaward. MTDC excludes

equipment, capital expenditures, charges for patient care, rental costs, tuition remission, scholarships

and fellowships, participant support costs, and the portion of each subaward in excess of $25,000.

The budget example at the end of this guide provides an example of how to calculate indirect costs with

a NICRA versus De Minimus Rate.

Allowable Costs

There are three items to consider when determining if a cost is allowable:

1) All costs included in the budget must meet the federal government’s definition of an allowable

cost as outlined in Uniform Guidance 2 CFR §200, Subpart E Cost Principles.

2) The applicant should also review the NOFO to check for any additional funding restrictions

provided by the federal awarding agency.

3) All costs must be allowable, allocable, reasonable, necessary, and consistently applied.

Allowable: Is the cost allowable with all federal and state regulations, with the program solicitation, with

the internal policies, and any other legal authority that would need to be followed? Make sure to conform

to any limitations or exclusions set forth in the terms and conditions of the federal award, or other

governing regulations as outlined by the awarding agency. Allowable costs should be adequately

documented and cannot be included as a cost or used to meet cost sharing or matching requirement of

any other federal award in either the current or prior fiscal period.

Example: Salaries and fringe for personnel to complete project activities are

allowable. If the scope of work requires the creation of social media content for

the project, then it would be allowable to pay a social media content creator using

award funds.

8

April 2022

Allocable: Can the cost be allocated or assigned to a particular federally funded project or program? Was

it incurred specifically for the award and can be distributed in proportions that “may be approximated

using reasonable methods?”

Example: A request is submitted to purchase a laptop for an employee not

working on the project. While a laptop can be an allowable expense, it is not

allocable to this project because the laptop is for an employee not working on the

project.

Reasonable: Would a reasonable or prudent person incur this cost?

Example: An employee submits a request for $250 premium noise canceling

headphones. Their job requires them to occasionally attend zoom meetings. Is

this a reasonable expense or would the $40 basic headphones be more

reasonable for this task?

Necessary: Based on the project and activities that are performed, is the cost necessary for this work?

The justification for each expense needs to explain why the cost is necessary to this project.

Example: An employee submits a request for statistical software. Is this software

necessary to meet the goals and objectives of the project or is the software

available through Microsoft Excel sufficient?

Consistently Applied: All costs should be treated consistently whether they are funded by federal or non-

federal funds and in accordance with the organization’s policies.

Example: If Program Officers at ABC company make an annual salary of

$75,000, then Program Officer positions added to a federal project must use

this salary. The salaries supported by federal funds must be consistent with the

organization’s salaries across all projects, federal and non-federal.

To Rec

In summary, a good rule of thumb in determining if the cost is allowable, is to ask whether the

cost is crucial, necessary, and indispensable for carrying out the scope of the project. If the

answer is yes and it meets the conditions listed above, then the cost is generally allowable.

9

April 2022

Unallowable Costs

These are expenses that should never be charged to a federal award. There are several sources for

identifying unallowable costs on a federal award. The Uniform Guidance contains a list of typically

unallowable costs. Examples of unallowable costs include: alcoholic beverages, promotional items

(magnets, nail files, key rings, t-shirts, etc.), entertainment, fundraising, and lobbying.

The project Notice of Award or Notice of Funding Opportunity will contain any project or federal agency

specific unallowable costs. For example, research or clinical related costs might not be allowable on the

award.

Supplanting is also prohibited on all federal awards. Supplanting is deliberately reducing state or local

funds because of the existence of federal funds. Federal funds must be used to supplement existing

funds for program activities and must not replace those funds that have been appropriated for the same

purpose.

It is imperative that the grantee monitors the grant budget and related supporting documents to ensure

unallowable expenses are never charged to a federal grant or cooperative agreement.

If grantees are ever unsure of the allowability of a cost, please contact the federal awarding agency’s

project officer or grant officer for guidance.

Calculating the Fringe Rate

If your organization does not have a pre-determined fringe benefit rate, you can calculate a fringe rate

for each salary and wage listed in the budget narrative using the formulas below:

Salaried Employee Fringe Benefit Rate = (Total Fringe Benefits/ Annual Wages) x 100

• A salaried employee makes $50,000 annually. The employee’s total annual fringe benefits are

$10,000.

• Divide the employee’s annual fringe benefits ($10,000) by their annual salary ($50,000):

$10,000/$50,000 = 0.20

• Multiply 0.20 by 100 to get the fringe benefit percentage: 0.20 X 100 = 20%

• The fringe benefit rate for this employee is 20%, which means your company is paying an

additional 20% on top of the base salary for this employee.

Hourly Employee Fringe benefit rate = (Total Fringe Benefits/ Annual Wages) x 100

• To calculate an hourly employee’s annual salary, multiply the hourly rate by the number of weeks

worked in a year (52) X the number of hours worked per week (40).

• Then follow the steps above to calculate the fringe benefit total.

10

April 2022

Creating a Budget Narrative

The following is an example of a budget template with instructions on how to complete each section.

The instructions are in italics and example language is in purple italics, along with helpful notes. Keep in

mind this is a sample template and any specific template provided by the applicant’s federal agency

should be followed.

SAMPLE BUDGET TEMPLATE

Organization: ABC Company

Project Title: Capacity Building for Public Health Analysts

Term: August 1, 2022 – July 31, 2023 (12 months)

Award Amount: $166,079

Ensure the term is consistent throughout the budget narrative, verify that the “Months” listed in the

tables do not exceed the term of the project. Example: The term of the project is 6 months, but items

are budgeted for 8 months. That would need to be revised to 6 months or less.

Salaries and Wages - $83,750

For each requested position, provide a justification and describe the responsibilities, relating it to the

accomplishment of specific program objectives.

Salaries charged to a federal award cannot exceed the Executive II Salary Cap. The FY22 cap is

$203,700. https://www.opm.gov/policy-data-oversight/pay-leave/salaries-wages/2022/executive-senior-level

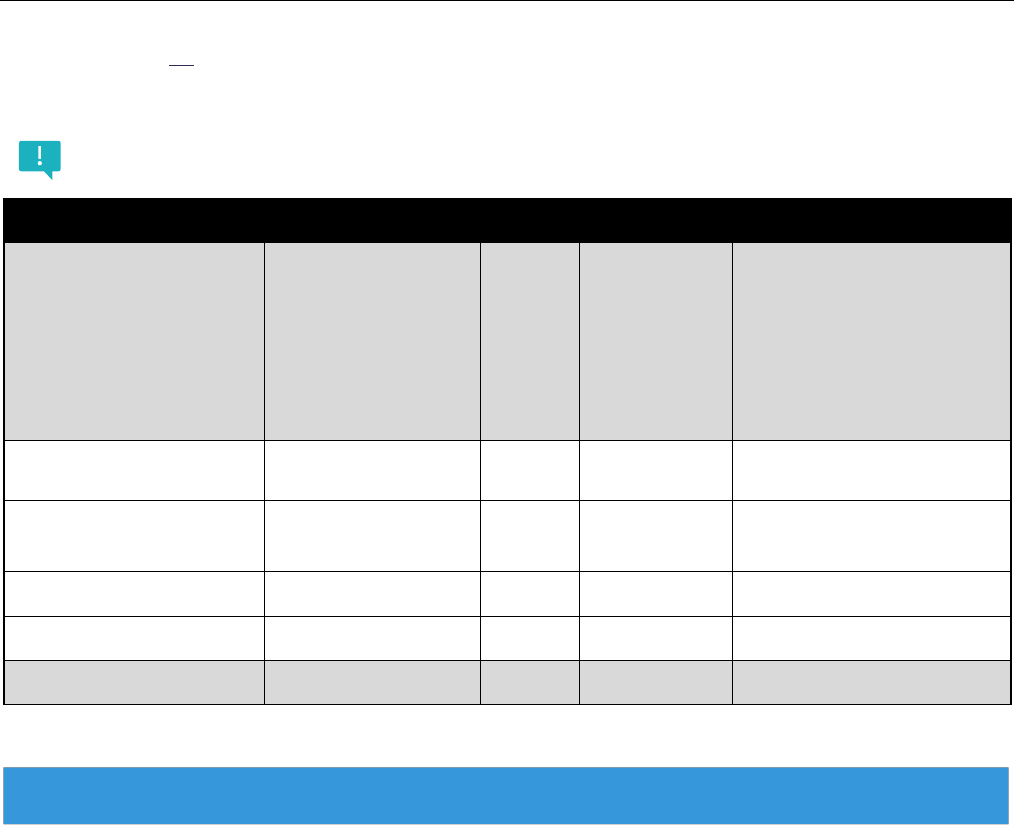

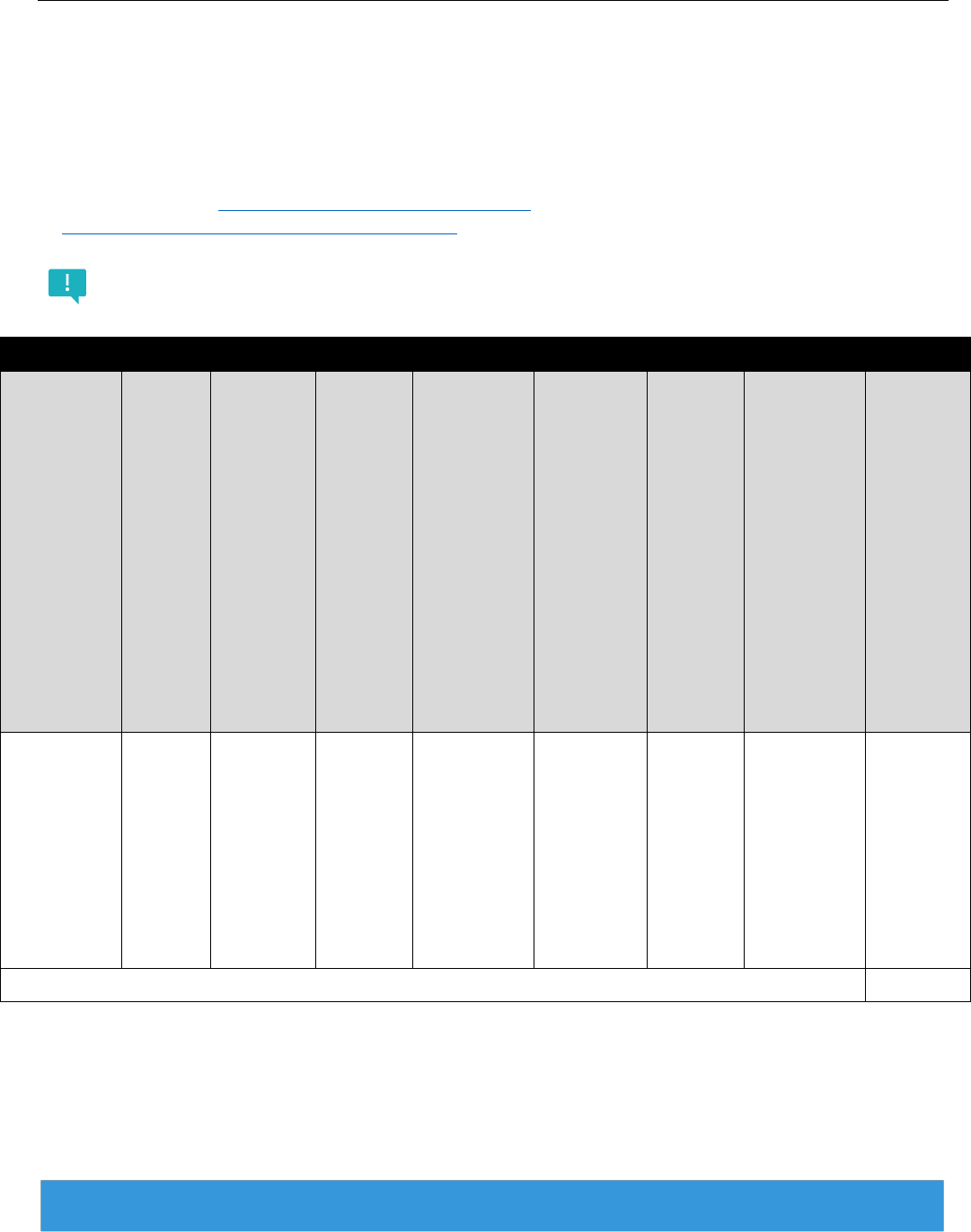

Salaries and Wages

Title

The job title of each

staff member

working on the

project.

Name

The name, if

known, of the

staff member

filling this

position. If the

position has

yet to be filled,

use TBD.

Annual

Salary

The staff

member’s

full annual

salary.

Must be

verifiable

by

paystubs.

Level of Effort

The level of

effort to reflect

the overall % of

time the staff

member will

work exclusively

on the project.

Months

The number of

months the staff

member will work

on the project, not

to exceed the

project

performance

period.

Total

Calculate the cost

of each staff

member’s salary:

(Annual salary x

level of effort %)/

number of

months working

on the project.

Project Coordinator

Taylor Smith

$75,000

25%

12 months

$18,750

Project Coordinator

Assistant

TBD

$50,000

75%

12 months

$37,500

Health Educator

Shawnda

Williams

$60,000

50%

8 months

$20,000

Graphic Designer

Patty Nguyen

$60,000

25%

6 months

$7,500

Total:

$83,750

11

April 2022

Provide a justification for each position listed in Salary and Wages. Describe the scope of responsibility for

each position, relating it to the accomplishment of the specific project objectives. Each justification should

include the title and name of the person and detail the scope of responsibility for these positions as related to

the specific program objectives.

• Project Coordinator (Taylor Smith): The Program Coordinator will dedicate 50% of their time to

the project by coordinating and organizing regular council meetings between all partner

organizations, ensuring compliance with program requirements, and serving as the central point

of contact for all project activities.

• Project Coordinator Assistant (TBD): The Project Coordinator Assistant will dedicate 75% of

his/her time to the project by engaging with stakeholders, coordinating day-to-day project

activities, collecting and analyzing data, and creating graphs and visuals to show project progress

(to be shared at stakeholder meetings)

• Health Educator (Shawnda Williams): The Health Educator will dedicate 50% of her time by

developing accurate and culturally relevant educational materials for the target population and

hosting educational events in the community.

• Graphic Designer (Patty Nguyen): The Graphic Designer will dedicate 25% of his time by

developing eye-catching and unique health communication materials that will be distributed to

the target population/communities using various communication channels.

Fringe Benefits - $18,425

Provide information on the rate of fringe benefits and the basis for their calculation.

Fringe Benefits: 22% of total salaries and wages proposed. Fringe benefits have been calculated to

account for all various line items fringe benefits will be specifically identified to each employee and

charged, individually, under the resulting agreement as direct costs.

If using a NICRA, add the following phrase to the above fringe benefit statement: “and in accordance

with [YOUR ORG’S] Negotiated Indirect Cost Rate Agreement (NICRA)”.

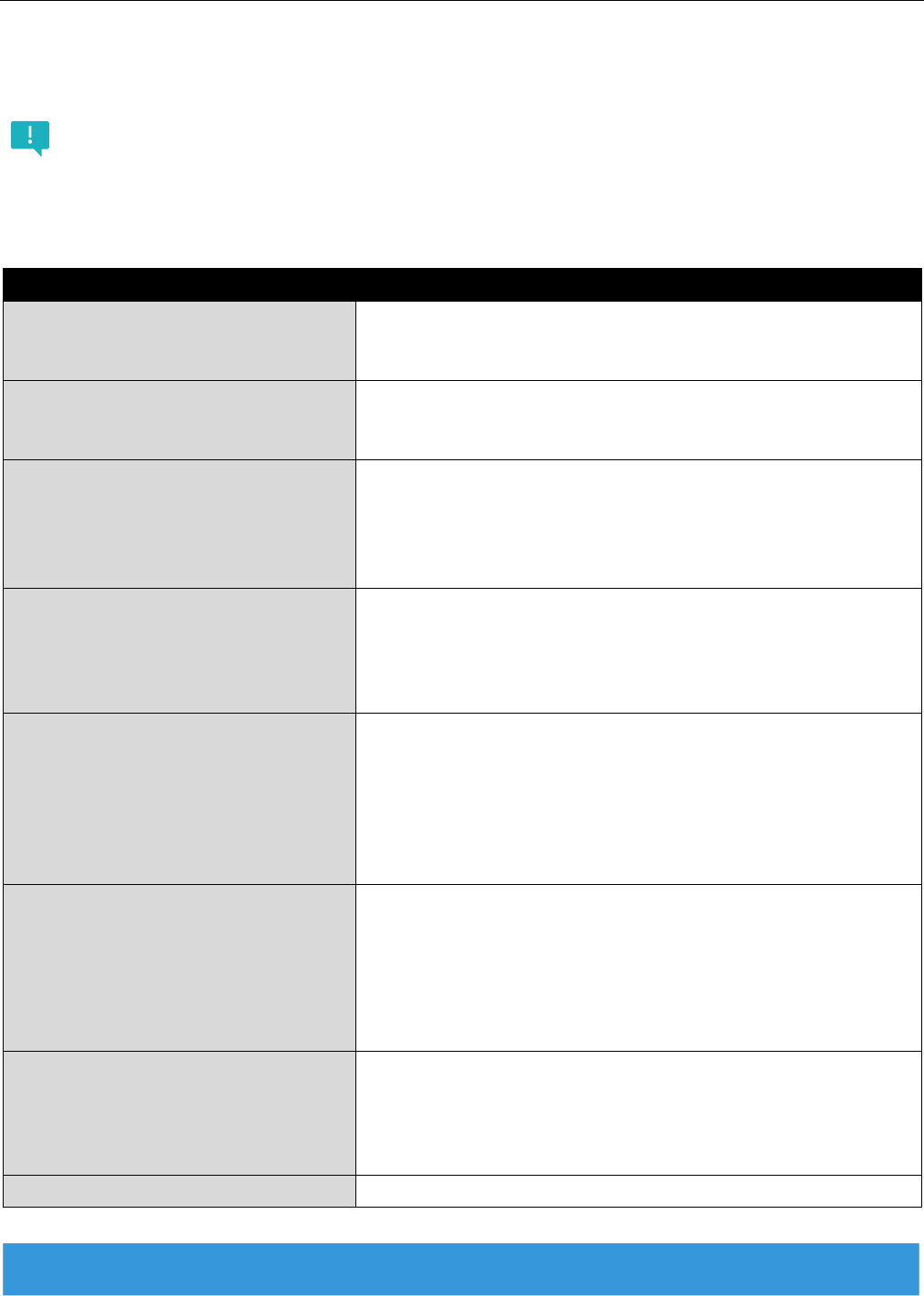

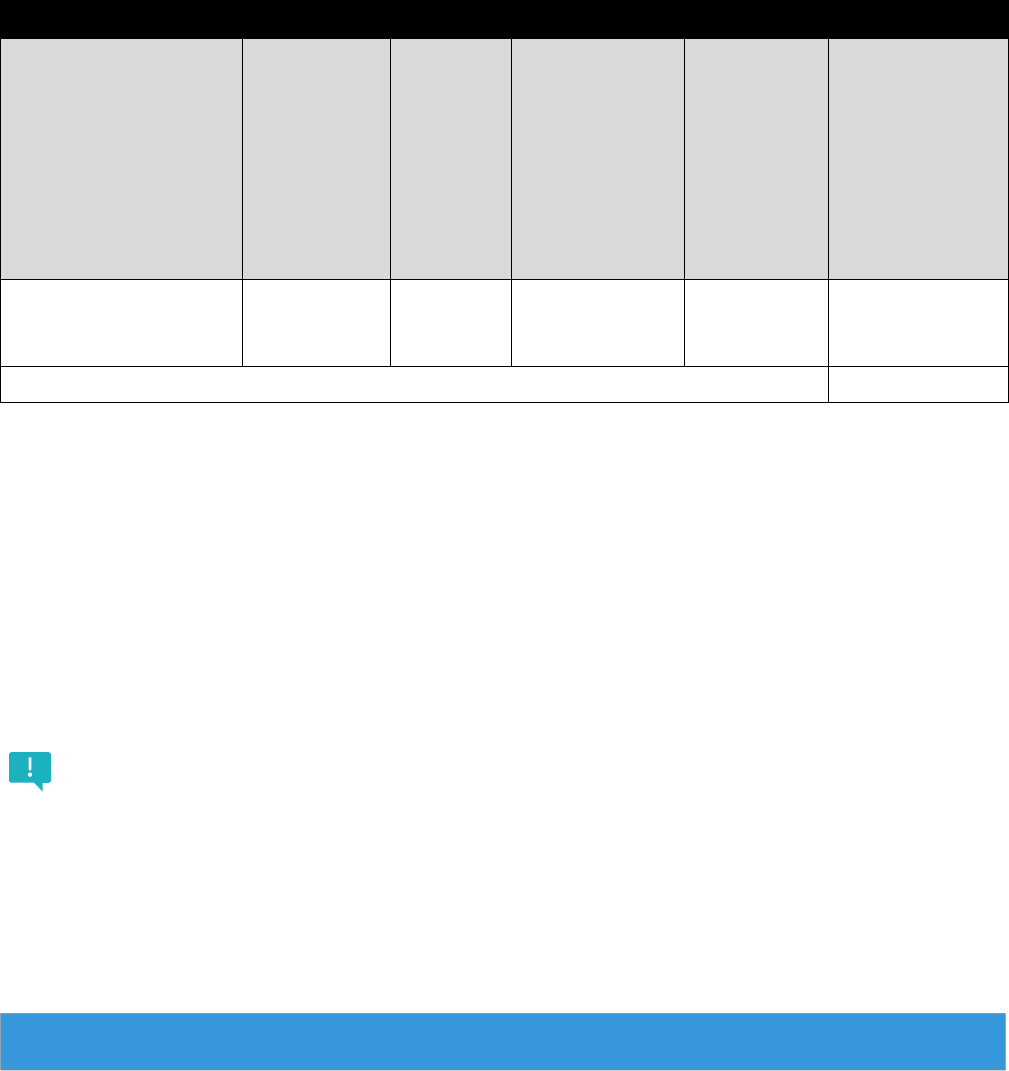

Fringe Benefits

Title

The Job title of each staff

member working on the

project listed in the above

salary section.

Name

The name, if known,

of the staff member

filling this position as

listed in the salary &

wages section.

Rate

The

fringe

benefit

rate.

Fringe Base

The total

salary for each

staff member

as listed in the

above salary

section.

Total

The total calculation of fringe

for each personnel listed.

(Rate x Fringe Base = Total)

Project Coordinator

Taylor Smith

22%

$18,750

$4,125

Project Coordinator

Assistant

TBD

22%

$37,500

$8,250

Health Educator

Shawnda Williams

22%

$20,000

$4,400

Outreach Director

Patty Nguyen

22%

$7,500

$1,650

Total:

$18,425

12

April 2022

Consultant Costs - $9,000

This category should be used when hiring an individual to give professional advice or services (e.g., training,

expert consultant, etc.) for a fee, but not as an employee of the subrecipient organization. Add a table per

consultant and update the title of the chart to Consultant 2, Consultant 3, etc.

The difference between Consultants and Contractors: Consultants are usually recognized as a

person who use their expertise and special knowledge to provide expert advice. After providing that

service, they are not responsible for the application of that advice. A Contractor can also provide

professional advice, but they will also be responsible for implementing that advice and conducting

project activities.

CONSULTANT 1

1. Name of Consultant:

Name of the consultant and description

of qualifications

Maria Rodriquez dba Spanish Translation Services

2. Organizational Affiliation:

Identify the organization affiliation of the

consultant, if applicable

N/A

3. Nature of Services to be

Rendered:

Describe the services, in detail, that will

be provided, including specific tasks and

deliverables.

Consultant will translate all promotion materials from English to

Spanish. Health promotional materials include up to 20 flyers, 5

posters, 3 pamphlets (to be used for ongoing community

outreach) and handbook to be provided to participants at three

community listening sessions.

4. Relevance of Service to the

Project:

Describe how the consultant’s services

are essential to the accomplishments of

the specific program objectives.

Health communication materials are an essential component of

the outreach activities included in this project and having the

materials available in both English and Spanish will expand our

footprint in the target community.

5. Number of Days of Consultation:

Specify the total number of hours or days

(as applicable) that the consultant will be

working on the project. Used as basis for

fee determination.

Note: Ensure the timeframe falls during

the term of the project.

90 days (May 1 to July 29, 2023)

6. Expected Rate of Compensation:

Specify the rate of compensation for the

consultant (e.g. rate per hour, rate per

day), as applicable. Include a budget

showing other costs, (e.g. travel, per

diem, supplies, and other related

expenses) and list a subtotal.

120 hours at a rate of $75 per hour for no more than $9,000

7. Method of Accountability:

Describe how the progress and

performance of the consultant will be

monitored. Identify who is responsible for

supervising the consultant agreement.

Consultant will report to project coordinator. Invoices will be

submitted on a monthly basis for total hours worked each month.

The final invoice will be submitted no later than August 15, 2022.

Total

$9,000

13

April 2022

Equipment - $8,500

Equipment is defined as tangible, non-expendable personal property (including exempt property*) that has a

useful life of more than one year AND an acquisition cost of $5,000 or more per unit. All equipment requests

should provide the requested information below. Provide a justification for the use of each item and relate it

to specific program objectives. Maintenance or rental fees for equipment should be shown in the OTHER

category.

• * Exempt property: This refers to property that will remain with the Subrecipient after the project

ends.

Equipment

Item Requested

Provide a

complete

description of the

item(s) being

requested. This

includes the

make and model

number, where

applicable.

Number

Needed

Provide the

number of

items needs

to support

the project

activities for

the duration

of the

performance

period.

Unit

Cost

Include

the unit

cost per

item.

Amount

Requested

Include the

amount

requested.

Justification

Provide a justification, including how the

equipment is essential to meet the

project activities.

Camera/video

equipment: JVC

GY-HM850U

ProHD Shoulder

Camcorder

1

$8,500

$8,500

Video/Camera equipment package

required to record testimonials and

communication materials that will be

used in media outreach activities.

Total Equipment

$8,500

Supplies - $2,696

Individually list each item requested and provide a justification for the use of each item and relate it to specific

program objectives. If appropriate, general office supplies may be shown by an estimated amount per month

times the number of months in the budget period.

A computing device is a supply if the acquisition cost is less than the lesser of the capitalization level

established by your organization for financial statement purposes or $5,000, regardless of the length

of its useful life. Best practice is to set electronic item price limits, i.e., desk computers, laptops, cell

phones. Additionally, the amount allocated should tie directly back to the personnel who will be using

the item.

14

April 2022

Supplies

Item

Requested

Provide a

complete

description of

the item(s) being

requested.

Number

Needed

Provide the

number of

items needs

to support

the project

activities for

the duration

of the

performance

period.

Unit

Cost

Include

the unit

cost per

item.

Amount

Requested

Include the

amount

requested.

Justification

Provide a justification, including how the

equipment is essential to meet the

project activities.

General Office

Supplies (pens,

pencils, paper,

folders,

notepads, post-

it notes)

12 months

(Note: the

number of

months

cannot

exceed the

performance

period)

$10 per

person

for four

team

members

$480.00

General office supplies are required to

support the day-to-day activities of the

project. The organization’s monthly

budget averages $10 per month per

employee and four employees will be

supporting this project.

Event Tents

3

$195.00

$585.00

Tents will be used at six community

outreach events to be conducted

where we will connect with the target

population. The tents will serve as a

focal point for the team and will allow

them to meet and connect with

members of the community.

Printer: HP

LaserJet Pro

M255dw

Wireless Color

Laser Printer

1

$365.00

$365.00

Printer will be used to print flyers to be

handed out at events and educational

materials to be used a community

listening session. The printer will be

used exclusively for this project.

Printer

Cartridges

2 of 2-pack

black

cartridges

$132.99

$265.98

Printer cartridges will provide printing

of up to 6,000 pages of materials

required for the outreach activities

Laptops

2

$1,000

$1,000

The 2 Dell Latitude 5520 laptops are

for the project coordinator and project

coordinator assistant to perform their

duties and responsibilities. Their LOEs

are 25% and 75%, respectively.

Therefore, requesting the portion

assigned to the project, which in this

case would be $1,000 [(.25x$1,000) +

(.75x$1,000)] instead of $2,000 since

these employees are not 100%

allocated to the grant.

Total Supplies

$2,695.98

15

April 2022

Travel - $2,432

Detail any travel planned for the program staff only. Travel for consultants and/or contractors should be shown

in the consultant and/or contractor categories, respectively. Provide a narrative justification describing the

travel staff members will perform. List where travel will be undertaken, number of trips planned, who will be

making the trips, and approximate dates. If mileage is to be paid, provide the number of miles and cost per

mile. If travel is by air, provide the estimated cost of airfare. If per diem/lodging is to be paid, indicate the

number of days and amount of daily per diem, as well as the number of nights and estimated cost of lodging.

Include the cost of ground transportation, when applicable.

Reimbursement should be based on the Federal per diem rates, which includes a ceiling for lodging. For

domestic rates, go to https://www.gsa.gov/travel-resources and click on per diem. For international rates, go

to https://aoprals.state.gov/web920/per_diem.asp and search foreign per diem rates by location.

All travel should be first booked according to the 2 CFR 200.475, then the organization’s travel policies,

whichever is more stringent. Ensure travel dates fall during the project period.

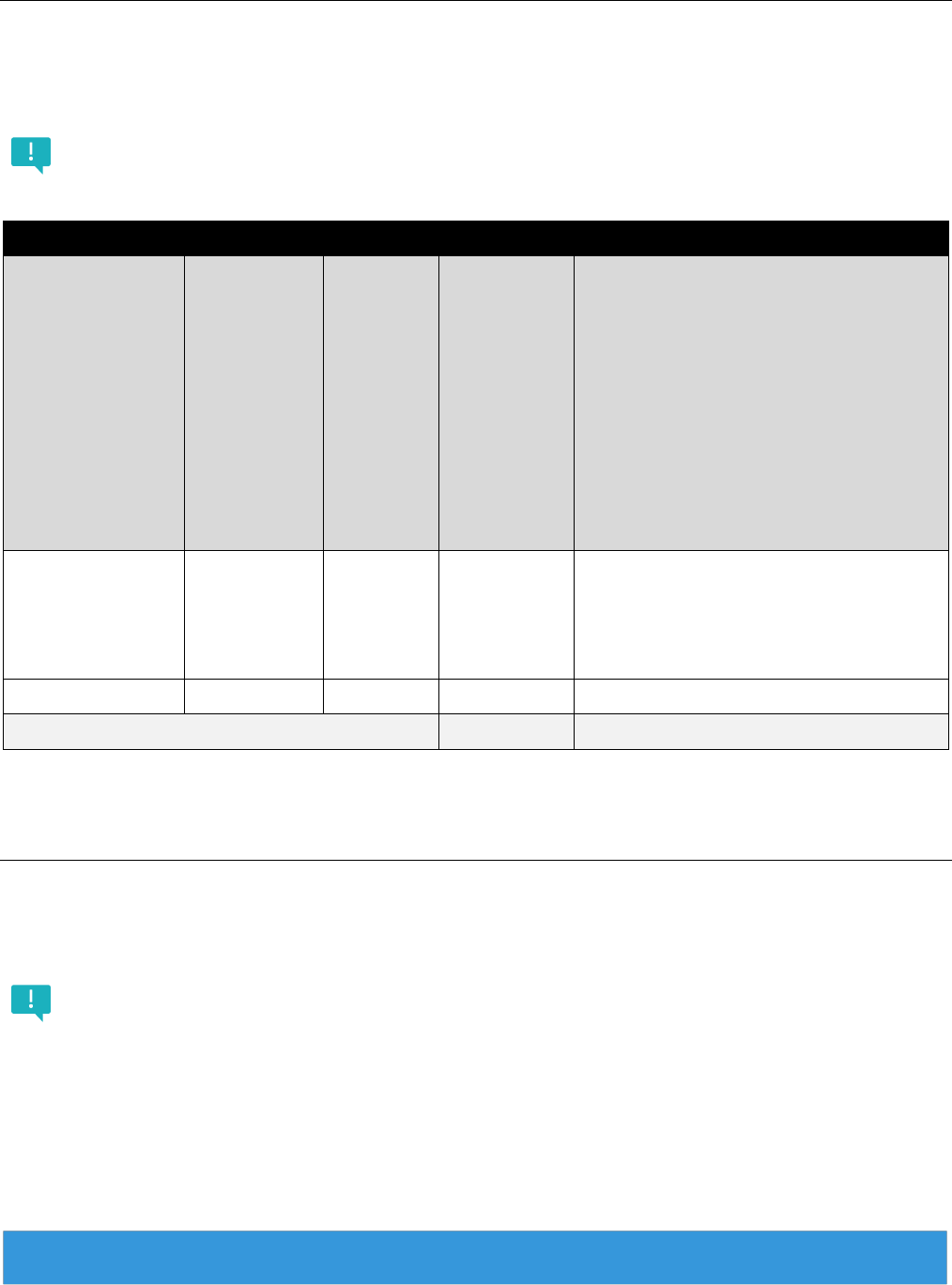

Out of State Travel

Trip

Descripti

on

Describe the

trip showing

the

departure

and

destination

cities.

# of

Trips

Total

number

of trips

planned

to this

destina

tion.

# of

People

Number

of staff

who will

be

traveling.

Length

of Trip

Length

of the

trip in

days and

nights

that the

travel

will

occur.

Est.

Airfare

The most

reasonable

and cost

effective

flight should

be chosen.

Per

Diem

Lodging

Refer to

the website

above to

determine

the

maximum

allowed for

lodging for

the

destination

city.

Per

Diem

M&IE

Refer to

the

website

above

for daily

per diem

rates.

Note:

there is a

reduced

rate for

first and

last day

of travel.

Est.

Ground

Transport

ation

Estimate for

ground

travel

to/from

airports and

relevant

travel, i.e.

attending

the

conference.

Total

Amount

Calculate

the total.

Program

Coordinat

or and

Health

Educator

to travel

from El

Paso, TX

to San

Diego, CA

1

2

3 days

and 2

nights

$1,010

$724

$370

$50

$2,154

Total

$2,154

16

April 2022

Provide a justification for each trip listed in Out of State Travel, including how the requested travel is essential

to meet the project activities.

Justification

• Out of State Travel: Project Coordinator and Health Educator will travel from El Paso, Texas to San

Diego, California to conduct a site visit at the 2nd location where the project activities are being

conducted. The Project Coordinator will provide expertise and advice to the project team leading

the work at the 2nd site, gather feedback on the project progress and assist the team with the

reporting requirements. The Health Educator will provide technical assistance to team members

and lead one of the community listening sessions. The trip is tentatively planned for June 14 –

16, 2023. The costs for the trip have been applied at the GSA rates for San Diego, CA. The costs

are broken down by person as: air fare $505; hotel room $181 pp per night; per diem is first and

last day at $55.50 each and day 2 at $74 for a total of $370; ground transportation is $25 each.

In-State/ Local Travel

Trip Description

Provide a description

of the trip(s).

# of Trips

Provide an

estimate of

the number

of trips that

will be taken

during the

performance

period.

# of

People

List the

number

of staff

members

who will

be

travelling.

Mileage

Provide an

estimate of the

total mileage

team members

will travel

during the

project

performance.

Mileage

Per Diem

Verify the

rate for the

appropriate

year to

determine

the mileage

rate.

Total Amount

Calculate the

total.

Travel to community

events and listening

sessions

9

2

475 miles total

$0.585

$277.88

Total

$277.88

Provide a justification for each trip listed in In-State/Local Travel, including how the requested travel is

essential to meet the project activities. Include the destination, if known.

Justification:

• The Project Coordinator Assistant and Health Educator will travel to and from the office to the

event sites and locations where the listening sessions are being conducted, using their personal

vehicles. This estimate of the 475 total mileage is based on return travel for two people during

the project performance period.

It is best practice to maintain mileage logs to substantiate all mileage costs charged to the project.

17

April 2022

Other - $2,650

This category contains items not included in the previous budget categories. Individually list each item

requested and provide appropriate justification related to the program objectives. Determine if the cost

should go in the first table or second table.

Examples of costs falling under this category are: rentals, stipends, utilities (only allowable if not captured

in the indirect rate), and memberships to training programs.

Other

Item Requested

Provide a detailed

description of the item

requested.

# of Months

List the number of

months the item will

be used for this

project. Note: this

cannot be longer than

the performance

period.

Estimated

Cost per

Month

Number of Staff

Provide the

number of team

members who will

directly support

the project.

Total Amount

Calculate the

total.

Cell Phone Stipend

12

$50

1

600

Total

$600

Other

Item Requested

Provide a detailed

description of the

item requested.

Number Needed

Provide the number of items needs

to support the project activities for

the duration of the performance

period.

Unit Cost

Include the unit

cost per item.

Total Amount

Calculate the total.

Background Check

1

$50

$50

Uber Rides

100

$20

$2,000

Total

$2,050

Provide a justification for each item listed in Other, including how the requested items are essential to meet

the project activities.

• Cell Phone Stipend: Cell phone stipend for the health educator to conduct day-to-day operations

while travelling to offsite meetings and other fieldwork activities.

• Background Check: Background check for the project coordinator assistant selected for hire,

prior to onboarding.

• Uber rides: round-trip transportation for participants attending events. It is estimated that up to

100 elderly residents and those with disabilities will require transportation to community events.

The cost is based on the average estimate of an uber ride from the residential areas in the target

service delivery areas to the event locations.

18

April 2022

Contractual - $15,719

This category should be used when hiring an individual to provide products or services needed to carry out

the project, but not as an employee of the organization. Add a table for each contractor and update the title

of the chart to Contractor 2, Contractor 3, etc.

The difference between Consultants and Contractors: Consultants are usually recognized as a

person who use their expertise and special knowledge to provide expert advice. After providing that

service, they are not responsible for the application of that advice. A Contractor can also provide

professional advice, but they will also be responsible for implementing that advice and conducting

project activities.

Competitive bids are highly encouraged when using federal funds. Sole Source contracts are

allowable, but they must be accompanied by a strong justification on why the organization or person

is the only one capable of delivering the work.

Contractor 1

1. Name of Contractor:

Include whether contract is an

individual or an organization, state

TBD if unknown. Note: One individual

at an organization is an organization.

XYZ Organization

2. Method of Selection:

State whether the contract is sole

source or competitive bid and include

an explanation.

Competitive bid. This organization was selected based on the

organization’s unique experiences in providing training services for

Community Based Organizations involved in community outreach.

3. Period of Performance:

Start and end dates. Dates must be

within the period of performance of

the project.

September 1, 2022 – June 30, 2023; 10 months

4. Scope of Work:

Describe specific services/tasks to be

performed by the contractor and relate

them to the accomplishment of the

program objectives. Deliverables

should be clearly defined.

SOW includes:

• Design and deliver training sessions for community outreach

advocacy activities (at least one in person)

• Provide ongoing technical assistance as well as overseeing

training effectiveness

5. Method of Accountability:

Describe how the contractor will be

monitored during and on close of the

contract period and who will be

providing the monitoring.

Subcontractor’s work will be monitored by the Project Coordinator.

At a minimum, there will be a bi-weekly check in, to be changed to

more frequent calls as needed and during high-peak times. A

progress report will be submitted on the last day of each month. The

detailed survey report can be delivered in lieu of the monthly report.

6. Itemized Budget and

Justification:

Provide an itemized budget with

appropriate justification. If applicable,

include any indirect cost paid under

the contract and the indirect cost rate

used.

Advocate ($45,000 per year x .25 FTE x 10 months) $9,375

Advocate Benefits x 25% of FTE Salary $2,344

Mandated Training/Technical Assistance - (Location TBD) $4,000

Total $15,719

Total

$15,719

19

April 2022

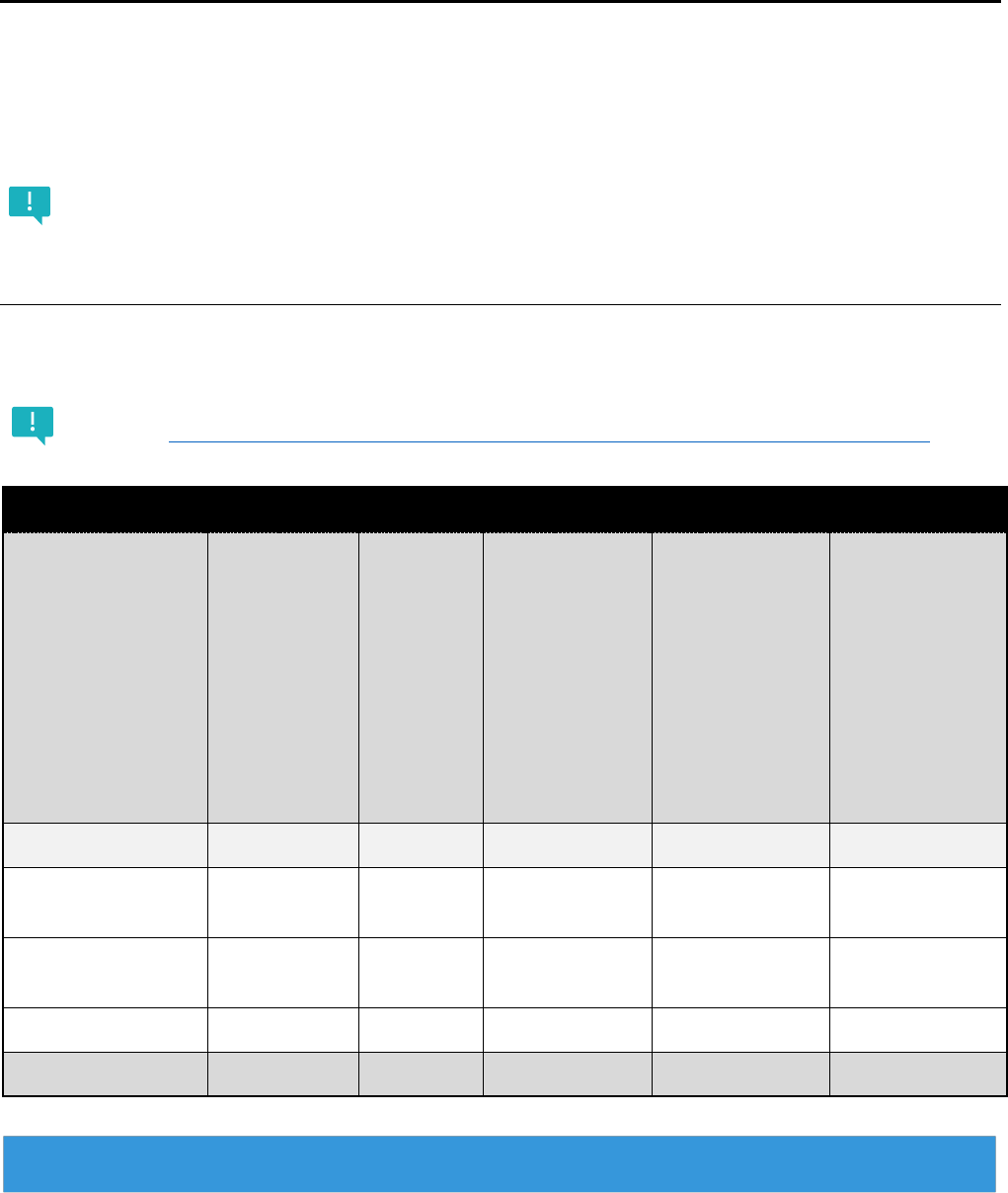

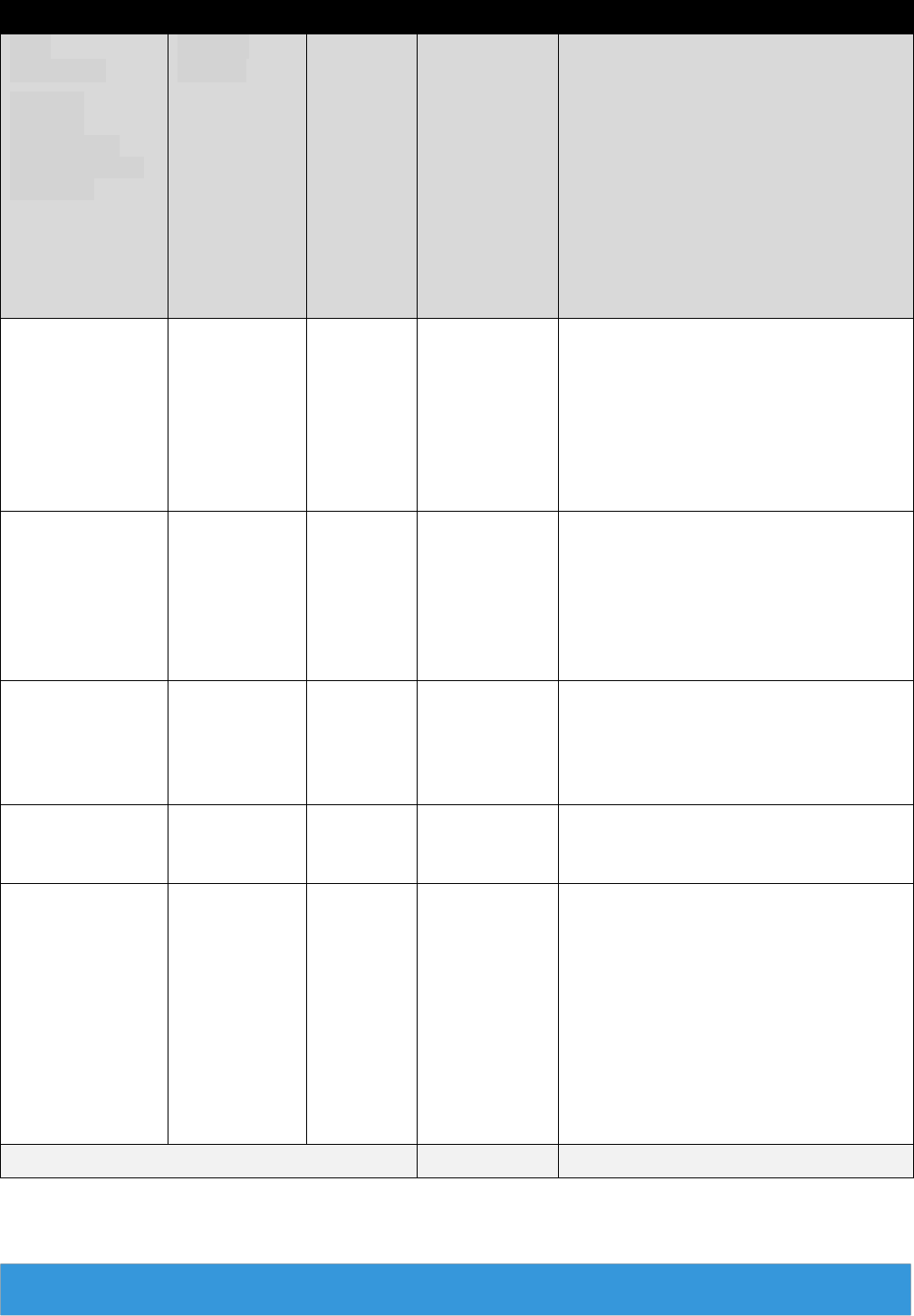

Direct Costs - $143,172

Show the direct costs by listing the totals of each category, including salaries and wages, fringe benefits,

consultant costs, equipment, supplies, travel, other, and contractual costs. Provide the total direct costs within

the budget in the chart below.

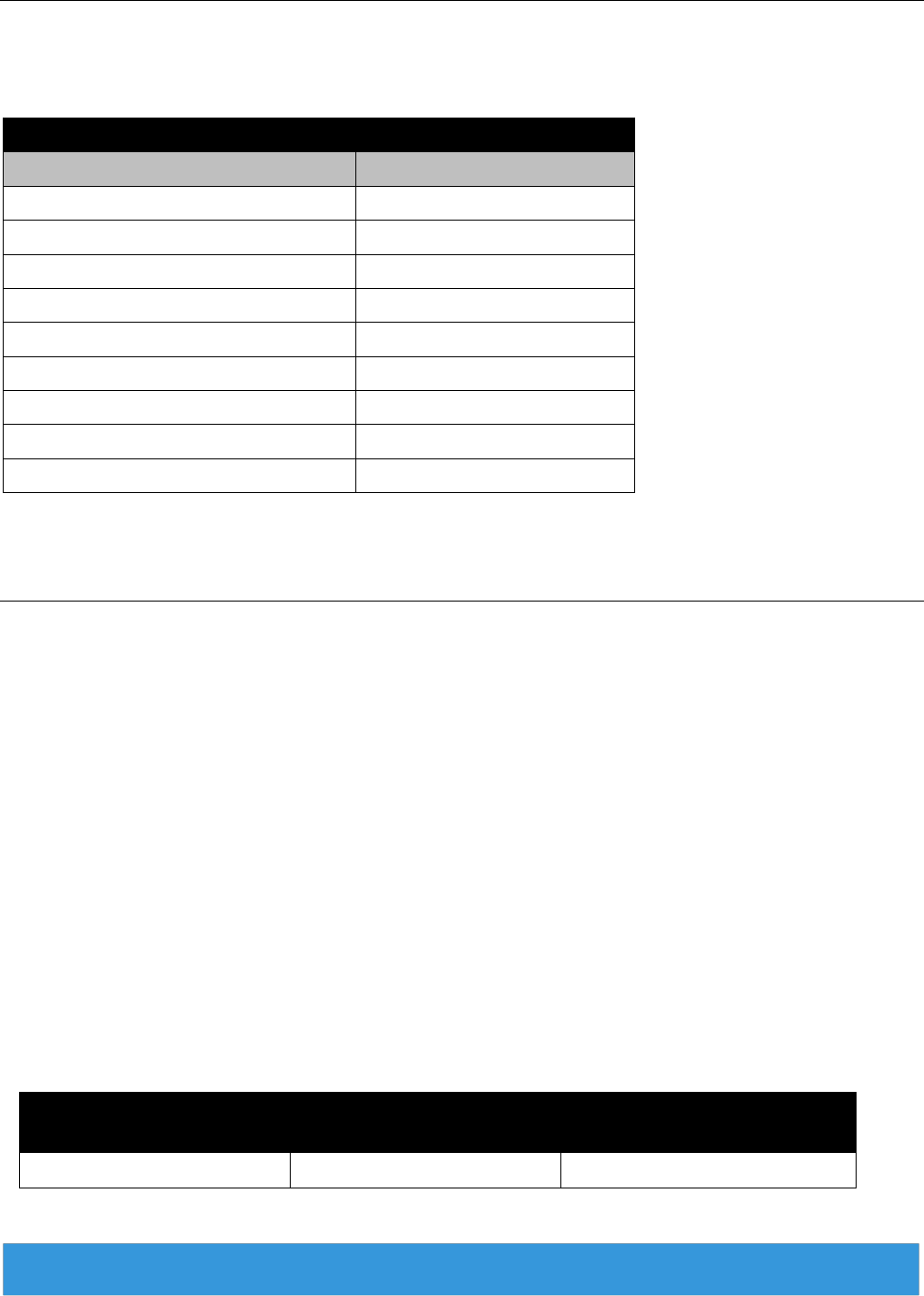

Direct Costs

Budget Category

Amount Requested

Salaries and Wages (Employees)

$83,750

Fringe Benefits

$18,425

Consultants

$9,000

Equipment

$8,500

Supplies

$2,696

Travel

$2,432

Other

$2,650

Contractual

$15,719

Total Direct Costs

$143,172

Indirect Costs - $22,907

OPTION 1: NICRA

To claim indirect costs, the organization must have a current negotiated indirect cost rate agreement (NICRA)

established with the cognizant federal agency. A copy of the most recent indirect cost agreement must be

provided as an attachment with the budget narrative.

Provide the following:

1) Date on the organization’s NICRA notification letter.

2) Negotiated indirect rate as indicated in your Agreement. Note: you cannot apply a rate that exceeds your

NICRA, however a lower rate may be used. For example, the organization’s NICRA may be 14% but you opt

to use a rate of 12%.

3) Period of time the NICRA is in effect. The NICRA must be in effect at the beginning of the project

performance period. If it has expired, the De Minimus Rate of 10% of the Modified Total Direct Cost (MTDC)

can be applied. Please see Option 2.

Indirect Cost Rate Agreement:

As stated in our NICRA, dated 09/01/2021 set forth an indirect rate of 16.00% for an effective period

spanning 12/01/2021 to 11/30/2023.

Total Applicable Direct

Costs

Indirect Cost Rate

Indirect Cost Total

$143,172

16%

$22,907

20

April 2022

OPTION 2: De Minimus Rate

If the organization does not have an established indirect cost rate agreement, they can choose to elect the de

minimus rate of 10% of the modified total direct costs (MTDC).

MTDC: All direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel,

and up to the first $25,000 of each subaward. MTDC excludes equipment, capital expenditures,

charges for patient care, rental costs, tuition remission, scholarships and fellowships, participant

support costs, and the portion of each subaward in excess of $25,000.

Our agency has never negotiated an indirect cost rate (NICRA) with a cognizant agency, and we elect to

use the 10 percent of Modified Total Direct Cost (MTDC) de minimis indirect rate to recover indirect costs

as part of this budget, should that be allowable.

Modified Total Direct Costs

(MTDC)

Indirect Cost Rate

Indirect Cost Total

$143,172

10%

$14,317

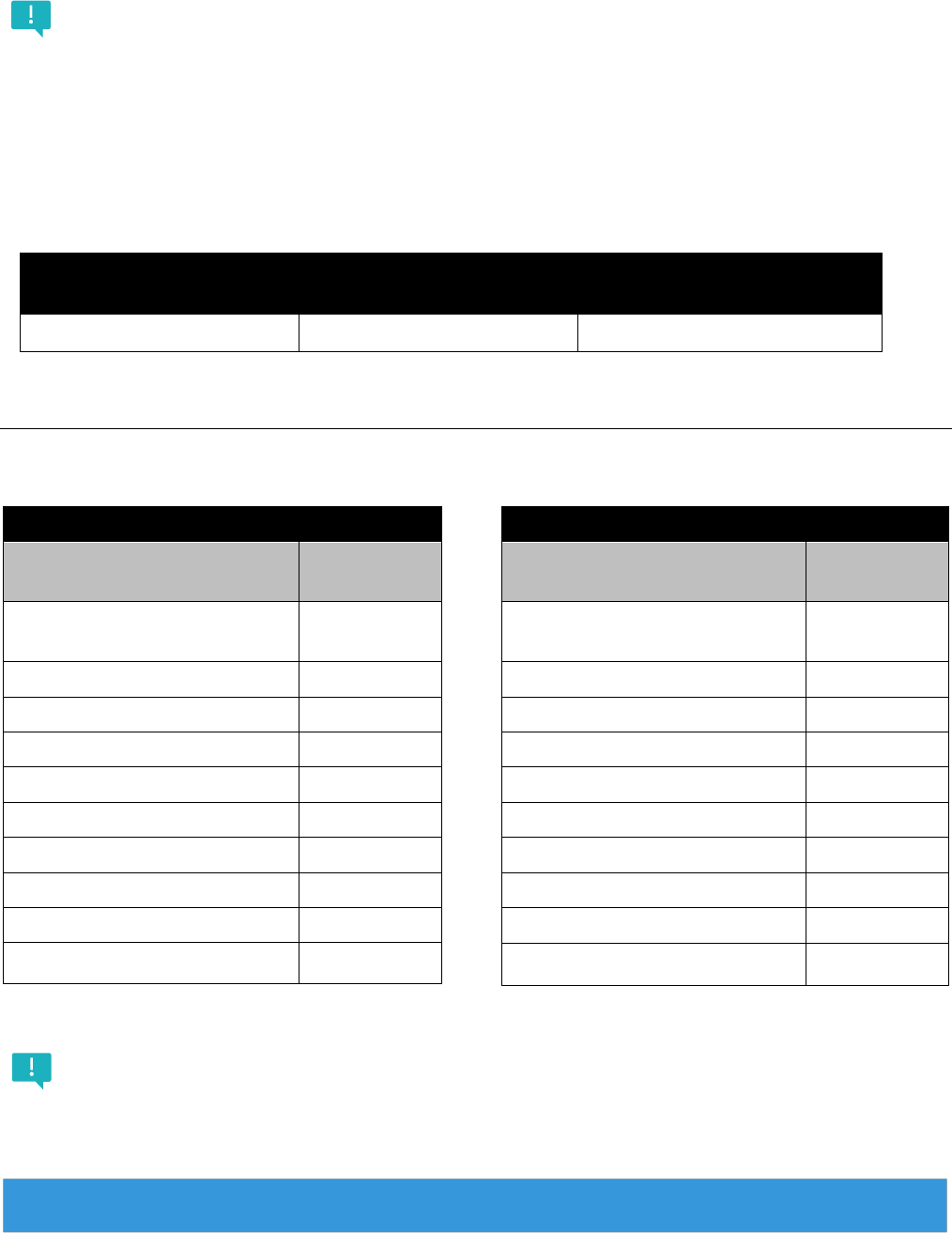

Total Budget - $166,079

OPTION 1- NICRA

Total Budget

Budget Category

Total

Requested

Salaries and Wages

(Employees)

$83,750

Fringe Benefits

$18,425

Consultants

$9,000

Equipment

$8,500

Supplies

$2,696

Travel

$2,432

Other

$2,650

Contractual

$15,719

Indirect Costs (16%- Option 1)

$22,907

Total Budget

$166,079

OPTION 2 – De Minimus Rate

Total Budget

Budget Category

Total

Requested

Salaries and Wages

(Employees)

$83,750

Fringe Benefits

$18,425

Consultants

$9,000

Equipment

$8,500

Supplies

$2,696

Travel

$2,432

Other

$2,650

Contractual

$15,719

Indirect Costs (10%- Option 2)

$14,317

Total Budget

$157,489

Always double check that the total budget amount listed above matches the award amount.